Starwood 2005 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2005 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

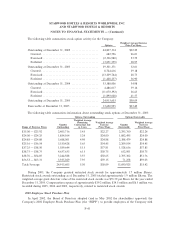

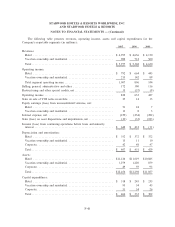

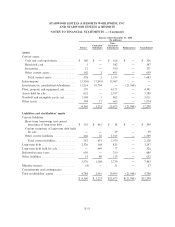

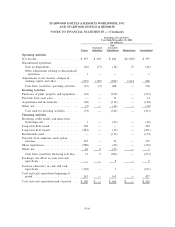

The following table presents revenues and long-lived assets by geographical region (in millions):

Revenues Long-Lived Assets

2005 2004 2003 2005 2004

(In millions)

United StatesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $4,656 $4,157 $3,600 $4,490 $5,304

Italy ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 450 434 404 826 889

All other international ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 871 777 626 1,657 1,257

Total ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $5,977 $5,368 $4,630 $6,973 $7,450

Other than Italy, there were no individual international countries, which comprised over 10% of the total

revenues of the Company for the years ended December 31, 2005, 2004 or 2003, or 10% of the total long-lived

assets of the Company as of December 31, 2005 or 2004.

Note 24. Guarantor Subsidiary

The Company's payment obligations under the Previous Senior Credit Facility, the Senior Notes and the

Convertible Debt are fully and unconditionally guaranteed by the Sheraton Holding Corporation, a wholly-

owned subsidiary (the ""Guarantor Subsidiary''). The obligation of the Guarantor Subsidiary under its

guarantee of the Senior Credit Facility, the Senior Notes and the Convertible Debt is equal in right of

payment to its obligations under the public debt issued by Sheraton Holding.

Under the terms of the new 2006 Facility (see Note 15. Debt for further discussion), the Sheraton

Holding Corporation guarantee will be released if Starwood no longer owns the majority of Sheraton Holding

Corporation. Under the proposed sale to Host, Starwood will be selling Sheraton Holding Corporation to Host.

Therefore, after the sale to Host closes, Sheraton Holding Corporation will no longer be a guarantor to

Starwood's 2006 Facility. In addition, under the indentures for the Senior Notes and the Convertible Debt, the

guarantee of Sheraton Holding Corporation will be removed if the guarantee is released by the 2006 Facility.

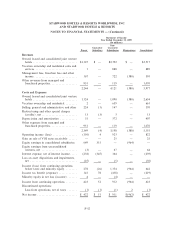

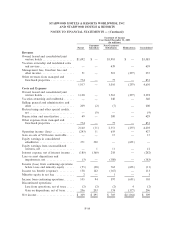

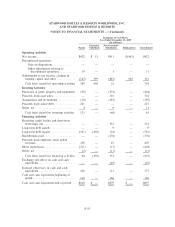

Presented below is condensed consolidating Ñnancial information for the Company (the ""Parent''), the

Guarantor Subsidiary and all other legal entities that are consolidated into the Company, including the Trust,

but which are not the Guarantor Subsidiary (the ""Non-Guarantor Subsidiaries''). Investments in subsidiaries

are accounted for by the Parent and the Guarantor Subsidiary on the equity method of accounting. Earnings of

subsidiaries are, therefore, reÖected in the Parent's and Guarantor Subsidiary's investments in subsidiaries'

accounts. The elimination entries eliminate investments in subsidiaries and intercompany balances and

transactions.

The December 31, 2004 balance sheet provided below has been adjusted to re-allocate to the Parent

certain cash payments made to ITT shareholders in connection with the 1998 acquisition of the Guarantor

Subsidiary and to adjust for certain tax allocations between the Parent, the Guarantor Subsidiary and certain

subsidiaries of the Guarantor Subsidiary. The adjustments increased the Guarantor Subsidiary's stockholders'

equity by $772 million and reduced its intercompany obligation to the Parent by the same amount. These

reclassiÑcations had no impact on the December 31, 2004 consolidated balance sheet of the Company or the

statements of income and cash Öows of the Parent, the Guarantor Subsidiary, the Non-Guarantor Subsidiar-

ies, or consolidated Ñnancial statements of the Company.

F-49