Starwood 2005 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2005 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

expected losses and/or receives a majority of the expected residual returns. In December 2003, the FASB

issued FIN 46(R) delaying the effective date for certain entities created before February 1, 2003 and making

other amendments to clarify the application of the guidance. In adopting FIN 46 and FIN 46(R), the

Company has evaluated its various variable interests to determine whether they are in VIE's. These variable

interests, which generally represent modest interests relative to the other investors in the ventures, are

primarily related to the Company's strategy to expand its role as a third-party manager of hotels and resorts,

allowing the Company to increase the presence of its lodging brands and gain additional cash flow. The

evaluation identified the following types of variable interests: (a) subordinated loans to ventures which have

typically taken the form of first or second mortgage loans, (b) equity investments in ventures which have

typically ranged from 10% to 30% of the equity, (c) guarantees to ventures which have typically related to loan

guarantees on new construction projects that are well capitalized and which typically expire within a few years

of the hotels opening and (d) other types of contributions to ventures owning hotels to secure the management

or franchise contract. The Company also reviewed its other management and franchise agreements related to

hotels that the Company has no other investments in and concluded that such arrangements were not variable

interests since the Company is paid at a level commensurate with the services provided and on the same level

as other operating liabilities and the hotel owners retain the right to terminate the arrangements under certain

circumstances.

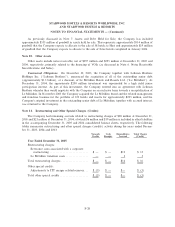

Of the over 700 hotels that the Company manages or franchises for third-party owners, the Company has

identified approximately 25 hotels that it has a variable interest in. For those ventures that the Company holds

a variable interest, it determined that the Company was not the PB and such VIE's should not be consolidated

in the Company's financial statements. The Company's outstanding net loan balances exposed to losses as a

result of its involvement in VIE's totaled $70 million and $75 million at December 31, 2005 and 2004,

respectively. Equity investments and other types of investments related to VIE's totaled $12 million and

$62 million, respectively, at December 31, 2005 and $34 million and $37 million, respectively, at Decem-

ber 31, 2004. Information concerning the Company's exposure to loss on loan guarantees and commitments to

fund other types of contributions is summarized in Note 22. Commitments and Contingencies.

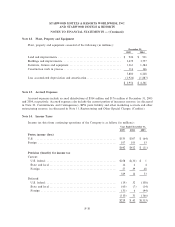

Note 3. Restricted Cash

State and local regulations governing sales of VOIs allow the purchaser of such a VOI to rescind the sale

subsequent to its completion for a pre-specified number of days. As such, cash collected from such sales

during the rescission period, as well as cash collected from sales before the certificate of occupancy is obtained

are both classified as restricted cash in the Company's consolidated balance sheets. At December 31, 2005 and

2004, the Company had $216 million and $200 million, respectively, of such restricted cash.

In addition, provisions of certain of the Company's secured debt require that cash reserves be maintained.

Additional cash reserves are required if aggregate operations of the related hotels fall below a specified level

over a specified time period. Additional cash reserves for certain debt became required in late 2003 following a

difficult period in the hospitality industry, resulting from the war in Iraq and the worldwide economic

downturn. The industry performance has since improved substantially, and in August 2005, the aggregate

hotel operations met the specified levels over the required time period, and the additional cash reserves, plus

accrued interest, were released to the Company. As of December 31, 2005 and 2004, $9 million and

$132 million, respectively, was included in restricted cash in the Company's consolidated balance sheets

related to these required cash reserves.

F-20