Starwood 2005 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2005 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

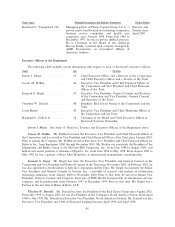

income taxes, in April 1999 we made an interest-bearing loan at 5.67% to Mr. Darnall of approximately

$416,000 to cover the taxes payable. Mr. Darnall's loan was repaid in 2004.

Other

Brett Gellein is Manager, Acquisitions and Purchases for Starwood Vacation Ownership. Mr. Gellein's

salary and bonus were $42,182 for 2004 and $86,769 for 2005. Brett Gellein is the son of Raymond Gellein,

who is the Chairman of the Board and Chief Executive OÇcer of Starwood Vacation Ownership.

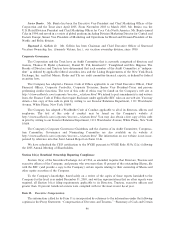

Item 14. Principal Accountant Fees and Services.

The Audit Committee has adopted a policy requiring pre-approval by the committee of all services (audit

and non-audit) to be provided to the Company by its independent auditors. In accordance with that policy, the

Audit Committee has given its approval for the provision of audit services by Ernst & Young LLP for Ñscal

2005. All other services must be speciÑcally pre-approved by the full Audit Committee or by a designated

member of the Audit Committee who has been delegated the authority to pre-approve the provision of

services.

Fees paid by the Corporation to its independent auditors are set forth in the proxy statement under the

heading ""Audit Fees'' and are incorporated herein by reference. The auditors do not speciÑcally allocate any

of the audit fees for the audit of the Trust.

PART IV

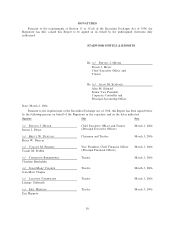

Item 15. Exhibits, Financial Statements, Financial Statement Schedules and Reports on Form 8-K.

(a) The following documents are Ñled as a part of this Joint Annual Report:

1. The Ñnancial statements and Ñnancial statement schedules listed in the Index to Financial

Statements and Schedules following the signature pages hereof.

2. Exhibits:

Exhibit

Number Description of Exhibit

2.1 Formation Agreement, dated as of November 11, 1994, among the Trust, the Corporation, Starwood

Capital and the Starwood Partners (incorporated by reference to Exhibit 2 to the Trust's and the

Corporation's Joint Current Report on Form 8-K dated November 16, 1994). (The SEC Ñle

numbers of all Ñlings made by the Corporation and the Trust pursuant to the Securities Exchange

Act of 1934, as amended, and referenced herein are: 1-7959 (the Corporation) and 1-6828 (the

Trust)).

2.2 Form of Amendment No. 1 to Formation Agreement, dated as of July 1995, among the Trust, the

Corporation and the Starwood Partners (incorporated by reference to Exhibit 10.23 to the Trust's

and the Corporation's Joint Registration Statement on Form S-2 Ñled with the SEC on June 29,

1995 (Registration Nos. 33-59155 and 33-59155-01)).

2.3 Transaction Agreement, dated as of September 8, 1997, by and among the Trust, the Corporation,

Realty Partnership, Operating Partnership, WHWE L.L.C., Woodstar Investor Partnership (""Wood-

star''), Nomura Asset Capital Corporation, Juergen Bartels, Westin Hotels & Resorts Worldwide,

Inc., W&S Lauderdale Corp., W&S Seattle Corp., Westin St. John Hotel Company, Inc., W&S

Denver Corp., W&S Atlanta Corp. and W&S Hotel L.L.C. (incorporated by reference to Exhibit 2

to the Trust's and the Corporation's Joint Current Report on Form 8-K Ñled with the SEC on

September 25, 1997, as amended by the Form 8-K/A Ñled with the SEC on December 18, 1997).

48