Starwood 2005 Annual Report Download - page 82

Download and view the complete annual report

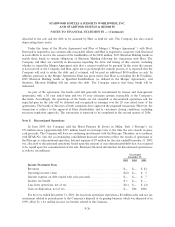

Please find page 82 of the 2005 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

the Ñnancial statements and the reported amounts of revenues and expenses during the reporting period.

Actual results could diÅer from those estimates.

ReclassiÑcations. Certain reclassiÑcations have been made to the prior years' Ñnancial statements to

conform to the current year presentation.

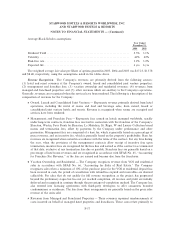

Impact of Recently Issued Accounting Standards. In December 2004, the FASB issued

SFAS No. 123(R), ""Share-Based Payment, a revision of FASB Statement No. 123, Accounting for Stock-

Based Compensation.'' SFAS No. 123(R) requires all share-based payments to employees, including grants

of employee stock options, to be recognized in the income statement based on their fair value. Proforma

disclosure is no longer an alternative. The new standard is eÅective for Ñscal years beginning after June 15,

2005 and therefore will be implemented by Starwood in the Ñrst quarter of 2006. Adoption of this standard will

reduce the Company's net income and earnings per share. Based on the Company's current share-based

payment compensation plan, the adoption of SFAS No. 123(R) using the modiÑed prospective method is

expected to result in a pre-tax expense of approximately $45 million or $0.13 of diluted earnings per Share in

2006.

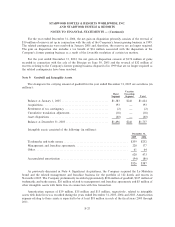

In December 2004 the FASB issued SFAS No. 152, ""Accounting for Real Estate Time-Sharing

Transactions.'' SFAS No. 152 amends SFAS No. 66 and SFAS No. 67 in association with the issuance of

AICPA SOP 04-2, ""Accounting for Real Estate Time-Sharing Transactions.'' These statements were issued

to address the diversity in practice caused by a lack of guidance speciÑc to real estate time-sharing

transactions. SFAS No. 152 is eÅective for Ñnancial statements for Ñscal years beginning after June 15, 2005

and therefore will be implemented by the Company in the Ñrst quarter of 2006. The Company expects the

adoption of this standard to have an impact on the timing of recognition of vacation ownership proÑts,

primarily marketing costs and the changes to the percentage of completion calculation, and result in a one-

time pre-tax charge to be recorded as a cumulative eÅect of an accounting change of approximately

$100 million to $120 million in the Ñrst quarter of 2006.

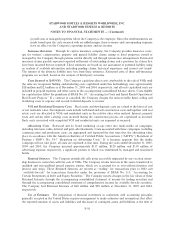

In December 2004, the FASB issued FASB StaÅ Position No. 109-2, ""Accounting and Disclosure

Guidance for the Foreign Repatriation Provision within the American Jobs Creation Act of 2004,'' in response

to the American Jobs Creation Act of 2004 (the ""Act'') which provides for a special one-time dividends

received deduction of 85 percent for certain foreign earnings that are repatriated (as deÑned in the Act) in

either an enterprise's last tax year that began before the December 2004 enactment date, or the Ñrst tax year

that begins during the one-year period beginning on the date of enactment. In the third quarter of 2005,

Starwood's Board of Directors adopted a plan to repatriate approximately $550 million and, accordingly, the

Company recorded a tax liability of approximately $47 million. In accordance with the Act, in the fourth

quarter of 2005 the Company borrowed these funds in Italy, repatriated them to the United States and

reinvested them pursuant to the terms of a domestic reinvestment plan which has been approved by the

Company's Board of Directors.

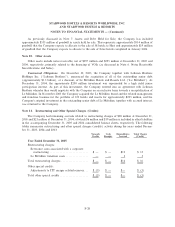

In November 2004, the Emerging Issues Task Force (""EITF'') issued EITF No. 04-8, ""The EÅect of

Contingently Convertible Debt on Diluted Earnings Per Share,'' which states that contingently convertible

debt instruments are subject to the if-converted method under FASB Statement No. 128, regardless of the

contingent features included in the instrument. As the terms of the contingently convertible debt instrument

allow for the Company to redeem such instruments in cash and the Company has a history of settling

convertible debt instruments in cash, the Company, in accordance with SFAS No. 128, has utilized the if-

converted method if certain trigger events are met. Accordingly, EITF No. 04-8 did not have an impact to the

Company's net income or earnings per share.

In January 2003, the FASB issued FIN 46 which requires a variable interest entity (""VIE'') to be

consolidated by its primary beneÑciary (""PB''). The PB is the party that absorbs a majority of the VIE's

F-19