Starwood 2005 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2005 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

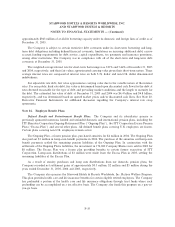

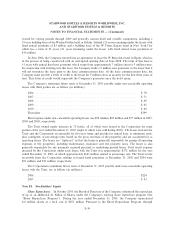

extend for varying periods through 2069 and generally contain Ñxed and variable components, including a

25-year building lease of the Westin Dublin hotel in Dublin, Ireland (21 years remaining under the lease) with

Ñxed annual payments of $3 million and a building lease of the W Times Square hotel in New York City

which has a term of 25 years (21 years remaining under the lease) with Ñxed annual lease payments of

$16 million.

In June 2004, the Company entered into an agreement to lease the W Barcelona hotel in Spain, which is

in the process of being constructed with an anticipated opening date of June 2008. The term of this lease is

15 years with annual Ñxed rent payments which range from approximately 7 million euros to 9 million euros.

In conjunction with entering into this lease, the Company made a 9 million euro guarantee to the lessor that it

will not terminate the lease prior to the lease commencement date. At the lease commencement date, the

Company must provide a letter of credit to the lessor for 9 million euros as security for the Ñrst three years of

rent. This letter of credit would supersede the Company's guarantee once the hotel opens.

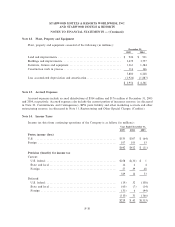

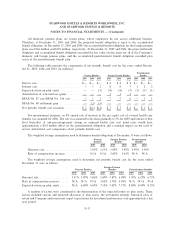

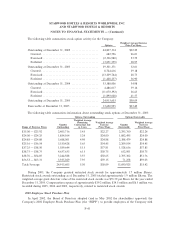

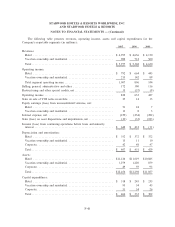

The Company's minimum future rents at December 31, 2005 payable under non-cancelable operating

leases with third parties are as follows (in millions):

2006ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 78

2007ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 71

2008ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 69

2009ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 65

2010ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 60

Thereafter ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $799

Rent expense under non-cancelable operating leases was $92 million, $85 million and $77 million in 2005,

2004 and 2003, respectively.

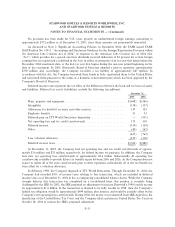

The Trust owned equity interests in 73 hotels, all of which were leased to the Corporation for some

portion of the year ended December 31, 2005 (eight of which were sold during 2005). The leases between the

Trust and the Corporation are generally for Ñve-year terms and provide for annual base, or minimum rents,

plus contingent, or percentage rents based on the gross revenues of the properties and are accounted for as

operating leases. The leases are ""triple-net'' in that the lessee is generally responsible for paying all operating

expenses of the properties, including maintenance, insurance and real property taxes. The lessee is also

generally responsible for any payments required pursuant to underlying ground leases. Total rental expense

incurred by the Corporation under such leases with the Trust was approximately $372 million for the year

ended December 31, 2005, of which approximately $141 million related to percentage rent. The Trust's rents

receivable from the Corporation relating to leased hotel properties at December 31, 2005 and 2004 were

$91 million and $70 million, respectively.

The Corporation's minimum future rents at December 31, 2005 payable under non-cancelable operating

leases with the Trust, are as follows (in millions):

2006ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $224

2007ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 93

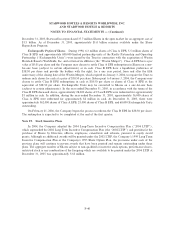

Note 18. Stockholders' Equity

Share Repurchases. In October 2005, the Board of Directors of the Company authorized the repurchase

of up to an additional $1 billion of Shares under the Company's existing share repurchase program (the

""Share Repurchase Program''). During the year ended December 31, 2005, the Company repurchased

4.0 million shares at a total cost of $253 million. Pursuant to the Share Repurchase Program, through

F-39