Starwood 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

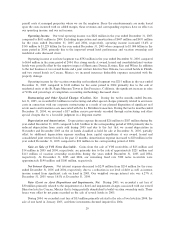

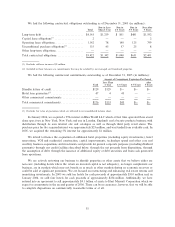

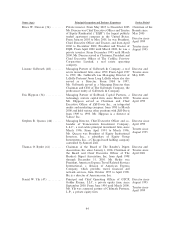

Cash Used for Financing Activities

The following is a summary of our debt portfolio (including capital leases) as of December 31, 2005:

Amount Interest Rate at

Outstanding at December 31, Average

December 31, 2005(a) Interest Terms 2005 Maturity

(Dollars in millions) (In years)

Floating Rate Debt

Senior Credit Facility:

Term LoanÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 450 LIBOR(b) °1.25% 5.64% 0.7

Revolving Credit Facility ÏÏÏÏÏÏ 11 CBA ° 1.25% 4.57% 0.8

Mortgages and Other ÏÏÏÏÏÏÏÏÏÏÏ 481 Various 4.05% 1.4

Interest Rate Swaps ÏÏÏÏÏÏÏÏÏÏÏÏ 300 8.77% Ì

Total/Average ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,242 5.77% 1.0

Fixed Rate Debt

Sheraton Holding Public Debt ÏÏÏ $ 148 7.75% 19.9

Senior Notes ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,494(c) 6.70% 3.9

Convertible DebtÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 360 3.50% 0.4

Mortgages and Other ÏÏÏÏÏÏÏÏÏÏÏ 649 7.07% 4.6

Interest Rate Swaps ÏÏÏÏÏÏÏÏÏÏÏÏ (300) 7.88% Ì

Total/Average ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $2,351 6.23% 4.5

Floating Rate Debt ClassiÑed as

Held for SaleÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 25 4.30% 4.0

Fixed Rate Debt ClassiÑed as

Held for SaleÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 527 7.59% 10.1

Total Debt

Total Debt and Average TermsÏÏÏ $4,145 6.27% 4.4

(a) Excludes approximately $469 million of our share of unconsolidated joint venture debt, all of which was non-recourse.

(b) At December 31, 2005, one-month LIBOR was 4.39%

(c) Includes approximately $(3) million at December 31, 2005 of fair value adjustments related to existing and terminated Ñxed-to-

Öoating interest rate swaps.

Recent Events. On February 21, 2006, we began the process to redeem the Class B EPS for $38.50 per

share. The redemption is expected to be completed at the end of the Ñrst quarter.

In February 2006, we closed a new, Ñve-year $1.5 billion Senior Credit Facility (""2006 Facility''). The

2006 Facility replaces the existing $1.45 billion Revolving and Term Loan Credit Agreement (""Existing

Facility'') which would have matured in October 2006. Approximately $240 million of the Term Loan balance

under the Existing Facility was paid down with cash and the remainder was reÑnanced with the 2006 Facility.

The 2006 Facility is expected to be used for general corporate purposes. The 2006 Facility matures

February 10, 2011 and has a current interest rate of LIBOR ° 0.70%. We currently expect to be in compliance

with all covenants of the 2006 Facility.

In February 2006 we defeased approximately $470 million of debt secured in part by several hotels that

are part of the transaction with Host Marriott Corporation. In order to accomplish this, we purchased Treasury

securities suÇcient to make the monthly debt service payments and the balloon payment due under the loan

agreement. The Treasury securities were then substituted for the real estate and hotels that originally served as

collateral for the loan. As part of the defeasance, the Treasury securities and the debt were transferred to a

third party successor borrower who in turn is ""liable'' for all obligations under this debt. As such, this debt will

not be reÖected on our balance sheet in the future.

36