Starwood 2005 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2005 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

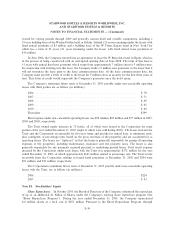

No provision has been made for U.S. taxes payable on undistributed foreign earnings amounting to

approximately $372 million as of December 31, 2005, since these amounts are permanently reinvested.

As discussed in Note 2. SigniÑcant Accounting Policies, in December 2004, the FASB issued FASB

StaÅ Position No. 109-2, ""Accounting and Disclosure Guidance for the Foreign Repatriation Provision within

the American Jobs Creation Act of 2004,'' in response to the American Jobs Creation Act of 2004 (the

""Act'') which provides for a special one-time dividends received deduction of 85 percent for certain foreign

earnings that are repatriated (as deÑned in the Act) in either an enterprise's last tax year that began before the

December 2004 enactment date, or the Ñrst tax year that begins during the one-year period beginning on the

date of the enactment. In 2005, Starwood's Board of Directors adopted a plan to repatriate approximately

$550 million and, accordingly, the Company recorded a tax liability of approximately $47 million. In

accordance with the Act, the Company borrowed these funds in Italy, repatriated them to the United States

and reinvested them pursuant to the terms of a domestic reinvestment plan which has been approved by the

Company's Board of Directors.

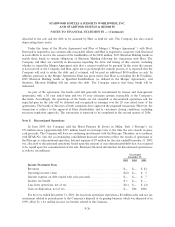

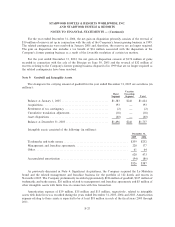

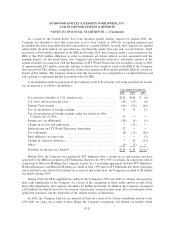

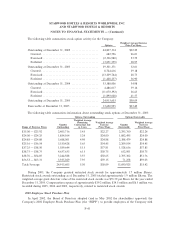

Deferred income taxes represent the tax eÅect of the diÅerences between the book and tax bases of assets

and liabilities. Deferred tax assets (liabilities) include the following (in millions):

December 31,

2005 2004

Plant, property and equipment ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $(448) $(546)

Intangibles ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (158) (157)

Allowances for doubtful accounts and other reserves ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 139 125

Employee beneÑts ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 51 53

Deferred gain on ITT World Directories disposition ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì (551)

Net operating loss and tax credit carryforwards ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 173 510

Deferred incomeÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (154) (134)

Other ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (40) (62)

(437) (762)

Less valuation allowance ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (125) (118)

Deferred income taxesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $(562) $(880)

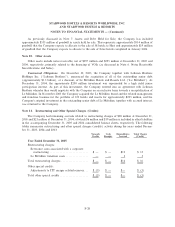

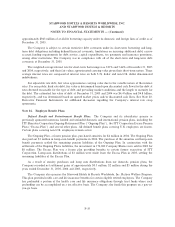

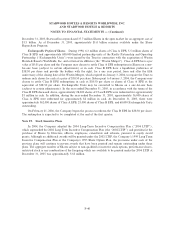

At December 31, 2005, the Company had net operating loss and tax credit carryforwards of approxi-

mately $16 million and $25 million, respectively, for federal income tax purposes. In addition, the Company

had state net operating loss carryforwards of approximately $2.4 billion. Substantially all operating loss

carryforwards available to provide future tax beneÑts expire between 2006 and 2026. As the Company does not

expect to utilize all of the state carryforwards prior to their expiration, substantially all of the tax beneÑt has

been oÅset by a valuation allowance.

In February 1998, the Company disposed of ITT World Directories. Through December 31, 2004, the

Company had recorded $551 of income taxes relating to this transaction, which are included in deferred

income taxes as of December 31, 2004 in the accompanying consolidated balance sheets. While the Company

strongly believes this transaction was completed on a tax-deferred basis, this position is currently being

challenged by the IRS. In 2002, the IRS proposed an adjustment to increase Starwood's 1998 taxable income

by approximately $1.4 billion. If the transaction is deemed to be fully taxable in 1998, then the Company's

federal tax obligation would be approximately $499 million, plus interest, and would be partially oÅset by the

Company's net operating loss carryforwards. During 2004, the matter was transferred from IRS Appeals to the

jurisdiction of the United States Tax Court and the Company Ñled a petition in United States Tax Court on

October 28, 2004 to contest the IRS's proposed adjustment.

F-31