Starwood 2005 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2005 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

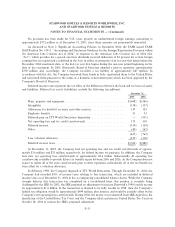

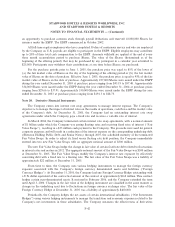

As a result of the United States Tax Court decision against another taxpayer in August 2005, the

Company has decided to treat this transaction as if it were taxable in 1998 for accounting purposes and

reclassiÑed the taxes associated with this transaction to a current liability. As such, the Company has applied

substantially all of its federal net operating loss carryforwards against this gain and accrued interest, which

resulted in a $360 million obligation to the IRS. In October 2005, the Company made a cash payment to the

IRS of this $360 million obligation in order to eliminate any future interest accrual associated with the

pending dispute. As discussed above, the Company had previously reserved a substantial amount of the

potential liability in connection with the disposition of ITT World Directories, but recorded a charge in 2005

of approximately $52 million, primarily relating to interest that would be owed to the IRS if the Company

does not prevail. This charge is comprised of a federal tax expense of $103 million partially oÅset by a state tax

beneÑt of $51 million. The Company believes that this transaction was completed on a tax deferred basis and

will continue to vigorously defend its position with the IRS.

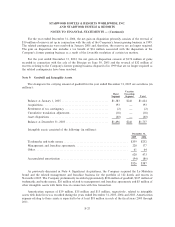

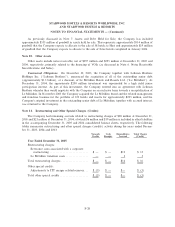

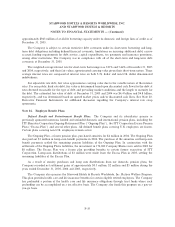

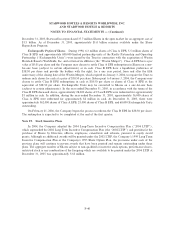

A reconciliation of the tax provision of the Company at the U.S. statutory rate to the provision for income

tax as reported is as follows (in millions):

Year Ended December 31,

2005 2004 2003

Tax provision (beneÑt) at U.S. statutory rate ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $225 $144 $ (4)

U.S. state and local income taxes ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (14) (37) (6)

Exempt Trust income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (64) (62) (60)

Tax on repatriation of foreign earnings ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 11 13 12

Tax on repatriation of foreign earnings under the American Jobs

Creation Act of 2004ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 47 Ì Ì

Foreign tax rate diÅerential ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (28) (6) (1)

Change in tax law and regulations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì (15) Ì

Deferred gain on ITT World Directories disposition ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 52 Ì Ì

Tax settlements ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (8) (15) (36)

Basis diÅerence on asset sales ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì (5)

Change in valuation allowance ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 7 24 (13)

Other ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (9) (3) Ì

Provision for income tax (beneÑt)ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $219 $ 43 $(113)

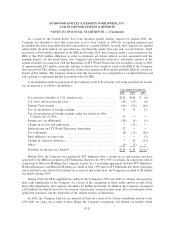

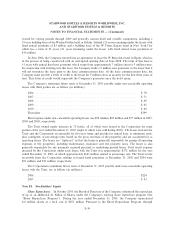

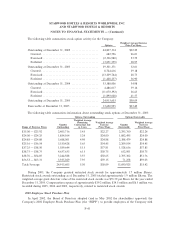

During 2005, the Company was notiÑed by ITT Industries that a refund of tax and interest had been

approved by the IRS for payment to ITT Industries related to its 1993-1995 tax returns. In connection with its

acquisition of Sheraton Holding, the Company is party to a tax sharing agreement between ITT Industries,

Hartford Insurance and Sheraton Holding as a result of their 1995 split of ITT Industries into these companies

and is entitled to one-third of this refund. As a result of this notiÑcation, the Company recorded an $8 million

tax beneÑt during 2005.

During 2004, the IRS completed its audits of the Company's 1999 and 2000 tax returns and issued its

Ñnal audit adjustments to the Company. As a result of the completion of these audits and the receipt of the

Ñnal audit adjustments, the Company recorded a $5 million tax beneÑt. In addition, the Company recognized

a $10 million tax beneÑt related to the reversal of previously accrued income taxes after an evaluation of the

applicable exposures and the expiration of the related statutes of limitations.

In 2003, the Company Ñled for tax amnesty in Italy for certain of its Italian subsidiaries related to the

1997-2001 tax years. As a result of these Ñlings, the Company recognized a $2 million tax beneÑt, which

F-32