Starwood 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.1999 and 2000. We believe that these accruals are no longer required as the related contingencies have been

resolved.

Income Tax Expense. The eÅective income tax rate for continuing operations for the year ended

December 31, 2004 was approximately 10.5%. Our eÅective income tax rate is determined by the level and

composition of pre-tax income subject to varying foreign, state and local taxes and other items. The eÅective

tax rate for the year ended December 31, 2004 beneÑted from approximately $28 million primarily related to

the reversal of tax reserves as a result of the resolution of certain tax matters during the year. For the year

ended December 31, 2003 we had a tax beneÑt of $113 million on a pre-tax loss of $11 million, primarily due

to the tax exempt Trust income and the favorable settlement of various tax matters.

LIQUIDITY AND CAPITAL RESOURCES

Cash From Operating Activities

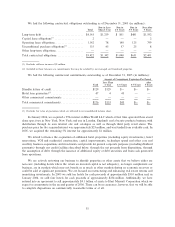

Cash Öow from operating activities is the principal source of cash used to fund our operating expenses,

interest payments on debt, maintenance capital expenditures and distribution payments by the Trust. We

anticipate that cash Öow provided by operating activities will be suÇcient to service these cash requirements.

We declared a distribution of $0.84 per Share to shareholders of record on December 31, 2005, 2004 and 2003.

We paid the 2003 distribution in January 2004, the 2004 distribution in January 2005, and the 2005

distribution in January 2006. In connection with the expected sale of 38 hotels to Host Marriott Corporation,

on February 17, 2006, the Trust declared a dividend of $0.21 per Share to shareholders of record on

February 28, 2006, which will be paid on March 10, 2006. In addition, on February 10, 2006, the Board

approved a dividend policy pursuant to which it is anticipated that the dividend will be held constant at

$0.84 per Share, including the Ñrst quarter dividend of $0.21. We believe that existing borrowing availability

together with capacity from additional borrowings and cash from operations will be adequate to meet all

funding requirements for our operating expenses, principal and interest payments on debt, maintenance capital

expenditures and distribution payments by the Trust for the foreseeable future.

State and local regulations governing sales of VOIs allow the purchaser of such a VOI to rescind the sale

subsequent to its completion for a pre-speciÑed number of days. As such, cash collected from such sales

during the rescission period, as well as cash collected from sales before the certiÑcate of occupancy is

obtained, are both classiÑed as restricted cash in our consolidated balance sheets. At December 31, 2005 and

2004, we have $216 million and $200 million, respectively, of such restricted cash.

In addition, provisions of certain of our secured debt require that cash reserves be maintained. Additional

cash reserves are required if aggregate operations of the related hotels fall below a speciÑed level over a

speciÑed time period. Additional cash reserves became required in late 2003 following a diÇcult period in the

hospitality industry, resulting from the war in Iraq and the worldwide economic downturn. The industry

performance has since improved substantially, and in August 2005, the aggregate hotel operations met the

speciÑed levels over the required time period, and the additional cash reserves, plus accrued interest, were

released to us. As of December 31, 2005 and 2004, $9 million and $132 million, respectively, is classiÑed as

restricted cash in our consolidated balance sheets related to these required cash reserves.

Cash From (Used for) Investing Activities

In November 2005, we acquired the Le Mπeridien brand and the related management and franchise

business for the portfolio of 122 hotels and resorts for approximately $225 million. The purchase price was

funded from available cash and the return of the original Le Mπeridien investment.

In limited cases, we have made loans to owners of or partners in hotel or resort ventures for which we

have a management or franchise agreement. Loans outstanding under this program, excluding the Westin

Boston, Seaport Hotel discussed below, totaled $151 million at December 31, 2005. We evaluate these loans

for impairment, and at December 31, 2005, believe these loans are collectible. Unfunded loan commitments,

excluding the Westin Boston, Seaport Hotel discussed below, aggregating $28 million were outstanding at

33