Starwood 2005 Annual Report Download - page 43

Download and view the complete annual report

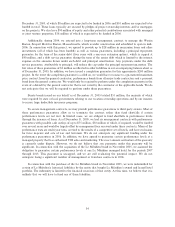

Please find page 43 of the 2005 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.¬Moody's aÇrmed our Ba1 rating and placed it on review for a potential upgrade, and simultaneously

placed the Ba1 ratings of Sheraton Holding Corporation on review for possible downgrade for the same

reasons cited above.

A distribution of $0.84 per Share was paid in January 2006, January 2005 and January 2004 to

shareholders of record as of December 31, 2005, 2004 and 2003, respectively. In connection with the expected

sale of 38 hotels to Host Marriott Corporation, on February 17, 2006, the Trust declared a dividend of

$0.21 per Share to shareholders of record on February 28, 2006, which will be paid on March 10, 2006. In

addition, on February 10, 2006, the Board approved a dividend policy pursuant to which it is anticipated that

the dividend will be held constant at $0.84 per Share, including the Ñrst quarter dividend of $0.21.

Stock Sales and Repurchases

At December 31, 2005, we had outstanding approximately 217 million Shares, 1.1 million partnership

units and 587,000 Class A EPS and Class B EPS. Through December 31, 2005, in accordance with the terms

of the Class B EPS, approximately 28,000 shares of Class B EPS were redeemed for approximately $1 million

in cash. In addition, during 2005, approximately 36,000 shares of Class A EPS were redeemed for

approximately $2 million in cash.

In October 2005, the Board of Directors of the Company authorized the repurchase of up to an additional

$1 billion of Shares under our existing Share repurchase program (the ""Share Repurchase Program'').

Pursuant to the Share Repurchase Program, Starwood repurchased 4.0 million Shares in the open market for

an aggregate cost of $253 million during 2005 and, through February 23, 2006, an additional 4.3 million

Shares were repurchased for an aggregate cost of $272 million in 2006. Approximately $771 million remains

available under the Share Repurchase Program.

OÅ-Balance Sheet Arrangements

Our oÅ-balance sheet arrangements include beneÑcial interest in securitizations of $68 million, third-

party loan guarantees of $47 million, letters of credit of $129 million, unconditional purchase obligations of

$135 million and surety bonds of $51 million. These items are more fully discussed earlier in this section and

in the Notes to Financial Statements, and Item 8 of Part II of this report.

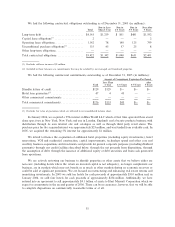

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

In limited instances, we seek to reduce earnings and cash Öow volatility associated with changes in

interest rates and foreign currency exchange rates by entering into Ñnancial arrangements intended to provide

a hedge against a portion of the risks associated with such volatility. We continue to have exposure to such

risks to the extent they are not hedged.

39