Starwood 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

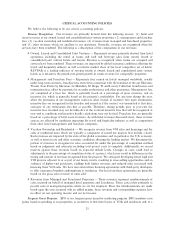

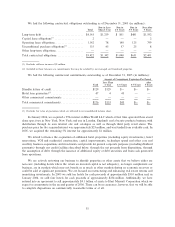

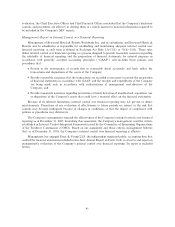

We had the following contractual obligations outstanding as of December 31, 2005 (in millions):

Due in Less Due in Due in Due After

Total Than 1 Year 1-3 Years 3-5 Years 5 Years

Long-term debt ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $4,143 $1,219 $ 851 $481 $1,592

Capital lease obligations(1) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2 Ì Ì Ì 2

Operating lease obligationsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,142 78 140 125 799

Unconditional purchase obligations(2) ÏÏÏÏÏÏÏÏÏÏÏ 135 45 57 25 8

Other long-term obligations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì Ì Ì Ì

Total contractual obligations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $5,422 $1,342 $1,048 $631 $2,401

(1) Excludes sublease income of $2 million.

(2) Included in these balances are commitments that may be satisÑed by our managed and franchised properties.

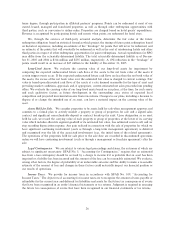

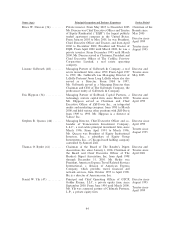

We had the following commercial commitments outstanding as of December 31, 2005 (in millions):

Amount of Commitment Expiration Per Period

Less Than After

Total 1 Year 1-3 Years 3-5 Years 5 Years

Standby letters of creditÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $129 $129 $Ì $Ì $Ì

Hotel loan guarantees(1)ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 47 4 43 Ì Ì

Other commercial commitments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì Ì Ì Ì

Total commercial commitments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $176 $133 $43 $Ì $Ì

(1) Excludes fair value of guarantees which are reÖected in our consolidated balance sheet.

In January 2004, we acquired a 95% interest in Bliss World LLC which at that time operated three stand

alone spas (two in New York, New York and one in London, England) and a beauty products business with

distribution through its own internet site and catalogue as well as through third party retail stores. The

purchase price for the acquired interest was approximately $25 million, and was funded from available cash. In

2005, we acquired the remaining 5% interest for approximately $1 million.

We intend to Ñnance the acquisition of additional hotel properties (including equity investments), hotel

renovations, VOI and residential construction, capital improvements, technology spend and other core and

ancillary business acquisitions and investments and provide for general corporate purposes (including dividend

payments) through our credit facilities described below, through the net proceeds from dispositions, through

the assumption of debt, through the issuance of additional equity or debt securities and from cash generated

from operations.

We are actively reviewing our business to identify properties or other assets that we believe either are

non-core (including hotels where the return on invested capital is not adequate), no longer complement our

business, are in markets which may not beneÑt us as much as other markets during an economic recovery or

could be sold at signiÑcant premiums. We are focused on restructuring and enhancing real estate returns and

monetizing investments. In 2005 we sold ten hotels for cash proceeds of approximately $510 million and, in

January 2006, we sold four hotels for cash proceeds of approximately $234 million. Additionally, we have

entered into an agreement to sell approximately $4.1 billion of assets to Host Marriott Corporation which we

expect to consummate in the second quarter of 2006. There can be no assurance, however, that we will be able

to complete dispositions on commercially reasonable terms or at all.

35