Starwood 2005 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2005 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

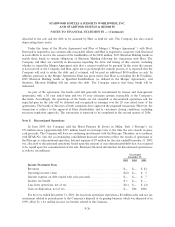

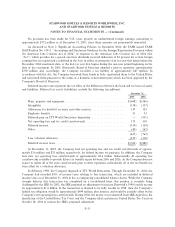

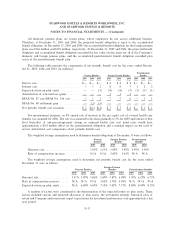

Noncash Cash Expenditures Total Charge

Credits Receipts Accrued (Credit)

Year Ended December 31, 2004

Restructuring charges (credits):

Adjustments to liability as a result of beneÑt

plan termination ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ Ì $ Ì $Ì $ Ì

Other special credits:

Adjustments from favorable settlement of

litigationÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $(37) $ Ì $Ì $(37)

Total other special credits ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $(37) $ Ì $Ì $(37)

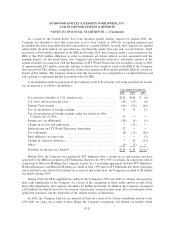

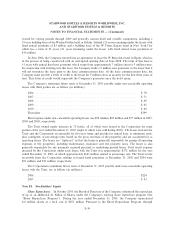

Year Ended December 31, 2003

Restructuring credits:

Adjustments to liability as a result of beneÑt

plan termination ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ (9) $ Ì $Ì $ (9)

Other special charges (credits):

Proceeds from favorable settlement of litigation $ Ì $(12) $Ì $(12)

Legal defense costsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì 13 13

Adjustments to receivables previously written

downÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì (1) (1)

Total other special charges (credits) ÏÏÏÏÏÏÏÏÏÏÏ $ Ì $(12) $12 $ Ì

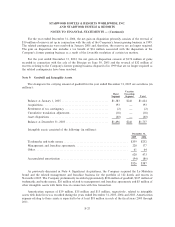

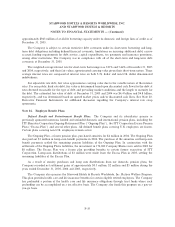

2005 Restructuring and Other Special Charges (Credits). During the year ended December 31, 2005,

the Company recorded a $13 million charge primarily related to severance costs in connection with the

Company's restructuring as a result of its planned disposition of signiÑcant real estate assets. The Company

also recorded $3 million of transition costs associated with the acquisition of the Le Mπeridien brand and

management business in November 2005. These charges were oÅset by the reversal of $3 million of reserves

related to the Company's acquisition of Sheraton Holding Corporation and its subsidiaries (formerly ITT

Corporation) in 1998 as the related obligations no longer exist.

2004 Other Special Credits. During the year ended December 31, 2004, the Company reversed a

$37 million special charge previously recorded in 1999 due to the favorable resolution of a litigation matter.

2003 Restructuring and Other Special Charges (Credits). During the year ended December 31, 2003,

the Company received $12 million in a favorable settlement of a litigation matter. This special credit was

oÅset by an increase of $13 million in a reserve for legal defense costs associated with a separate litigation

matter. Additionally, the Company reversed through restructuring credits a $9 million liability that was

originally established in 1997 for the ITT Excess Pension Plan through restructuring charges and is no longer

required as the Company Ñnalized the settlement of its remaining obligations associated with the plan.

F-29