Starwood 2005 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2005 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

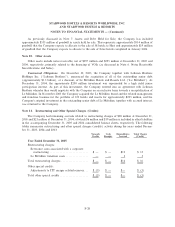

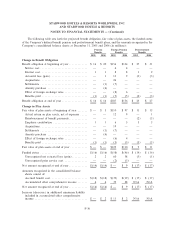

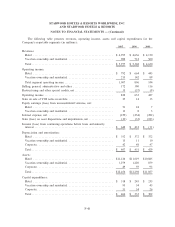

The weighted average asset allocations at December 31, 2005 and 2004 for the Company's domestic

deÑned beneÑt pension and postretirement beneÑt plans and the Company's current target asset allocation

ranges are as follows:

Pension BeneÑts Foreign Pension BeneÑts Postretirement BeneÑts

Target Target TargetPercentage of Percentage of Percentage of

Allocation Allocation AllocationPlan Assets Plan Assets Plan Assets

2005 2004 2005 2004 2005 2004

Equity securities ÏÏÏÏÏÏÏÏ N/A N/A N/A 59% 64% 66% 60% 67% 63%

Debt securities ÏÏÏÏÏÏÏÏÏÏ N/A N/A N/A 40% 32% 29% 40% 33% 35%

Cash and other ÏÏÏÏÏÏÏÏÏ N/A N/A N/A 1% 4% 5% 0% 0% 2%

100% 100% 100% 100% 100% 100%

The investment objective of the foreign pension plans and postretirement beneÑt plan is to seek long-term

capital appreciation and current income by investing in a diversiÑed portfolio of equity and Ñxed income

securities with a moderate level of risk. At December 31, 2005, all remaining domestic pension plans are

unfunded plans.

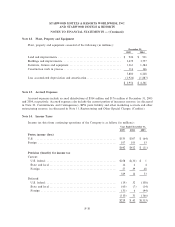

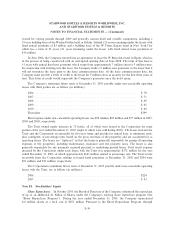

The Company expects to contribute approximately $1 million to its domestic pension plans, approxi-

mately $9 million to its foreign pension plans, and approximately $2 million to the postretirement beneÑt plan

in 2006. The following table represents the Company's expected pension and postretirement beneÑt plan

payments for the next Ñve years and the Ñve years thereafter (in millions):

Pension Foreign Pension Postretirement

BeneÑts BeneÑts BeneÑts

2006 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1 $ 7 $2

2007 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1 $ 7 $2

2008 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1 $ 7 $2

2009 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1 $ 8 $2

2010 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1 $ 8 $1

2011 - 2015 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $6 $52 $5

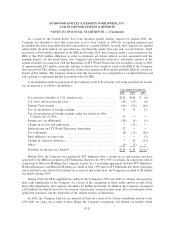

DeÑned Contribution Plans. The Company and its subsidiaries sponsor various deÑned contribution

plans, including the Starwood Hotels & Resorts Worldwide, Inc. Savings and Retirement Plan, which is a

voluntary deÑned contribution plan allowing participation by employees on U.S. payroll who meet certain age

and service requirements. Each participant may contribute on a pretax basis between 1% and 18% of his or her

compensation to the plan subject to certain maximum limits. The plan also contains provisions for matching

contributions to be made by the Company, which are based on a portion of a participant's eligible

compensation. The amount of expense for matching contributions totaled $22 million in 2005, $20 million in

2004 and $18 million in 2003.

Multi-Employer Pension Plans. Certain employees are covered by union sponsored multi-employer

pension plans. Pursuant to agreements between the Company and various unions, contributions of $11 million

in 2005, $10 million in 2004 and $8 million in 2003 were made by the Company and charged to expense.

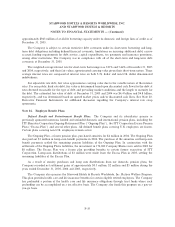

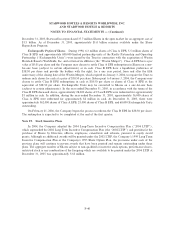

Note 17. Leases and Rentals

The Corporation leases certain equipment for the hotels' operations under various lease agreements. The

leases extend for varying periods through 2015 and generally are for a Ñxed amount each month. In addition,

several of the Corporation's hotels are subject to leases of land or building facilities from third parties, which

F-38