Starwood 2005 Annual Report Download - page 33

Download and view the complete annual report

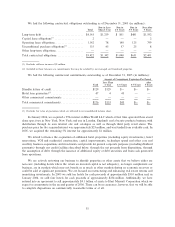

Please find page 33 of the 2005 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.payroll costs at managed properties where we are the employer. Since the reimbursements are made based

upon the costs incurred with no added margin, these revenues and corresponding expenses have no eÅect on

our operating income and our net income.

Operating Income. Our total operating income was $822 million in the year ended December 31, 2005

compared to $653 million in 2004. Excluding depreciation and amortization of $407 million and $431 million

for the years ended December 31, 2005 and 2004, respectively, operating income increased 13.4% or

$145 million to $1.229 billion for the year ended December 31, 2005 when compared to $1.084 billion in the

same period in 2004, primarily due to the improved owned hotel performance and vacation ownership and

residential sales discussed above.

Operating income at our hotel segment was $792 million in the year ended December 31, 2005 compared

to $664 million in the same period of 2004. Our strong results at owned, leased and consolidated joint venture

hotels were partially oÅset by the negative impact of Hurricanes Dennis, Katrina, Rita and Wilma. In addition

to the lost business at two owned hotels and a joint venture hotel in New Orleans, two owned hotels in Florida

and two owned hotels in Cancun, Mexico, we incurred insurance deductible expenses associated with the

property damage.

Operating income for the vacation ownership and residential segment was $215 million in the year ended

December 31, 2005 compared to $142 million for the same period in 2004 primarily due to the sale of

residential units at the St. Regis Museum Tower in San Francisco, California, the signiÑcant increase in sales

of VOIs and percentage of completion accounting methodology discussed above.

Restructuring and Other Special Charges (Credits), Net. During the twelve months ended Decem-

ber 31, 2005, we recorded $13 million in restructuring and other special charges primarily related to severance

costs in connection with our corporate restructuring as a result of our planned disposition of signiÑcant real

estate assets and transition costs associated with the Le Mπeridien transaction. During the twelve months ended

December 31, 2004, we reversed a $37 million reserve previously recorded through restructuring and other

special charges due to a favorable judgment in a litigation matter.

Depreciation and Amortization. Depreciation expense decreased $26 million to $387 million during the

year ended December 31, 2005 compared to $413 million in the corresponding period of 2004 primarily due to

reduced depreciation from assets sold during 2005 and due to the fact that we ceased depreciation in

November and December 2005 on the 41 hotels classiÑed as held for sale at December 31, 2005, partially

oÅset by additional depreciation expense resulting from capital expenditures at our owned, leased and

consolidated joint venture hotels in the past 12 months. Amortization expense increased to $20 million in the

year ended December 31, 2005 compared to $18 million in the corresponding period of 2004.

Gain on Sale of VOI Notes Receivable. Gains from the sale of VOI receivables of $25 million and

$14 million in 2005 and 2004, respectively, are primarily due to the sale of approximately $221 million and

$113 million of vacation ownership receivables during the years ended December 31, 2005 and 2004,

respectively. At December 31, 2005 and 2004, our remaining Ñxed rate VOI notes receivable were

approximately $190 million and $180 million, respectively.

Net Interest Expense. Net interest expense decreased to $239 million from $254 million for the years

ended December 31, 2005 and 2004, respectively, due to a reduction in our level of debt as well as interest

income earned from signiÑcant cash on hand in 2005. Our weighted average interest rate was 6.27% at

December 31, 2005 versus 5.81% at December 31, 2004.

Gain (Loss) on Asset Dispositions and Impairments, Net. During 2005, we recorded a net loss of

$30 million primarily related to the impairment of a hotel and impairment charges associated with our owned

Sheraton hotel in Cancun, Mexico that is being partially demolished to build vacation ownership units. These

losses were oÅset by net gains recorded on the sale of several hotels in 2005.

During 2004, we recorded a net loss of $33 million primarily related to the sale of two hotels in 2004, the

sale of one hotel in January 2005, and three investments deemed impaired in 2004.

29