Rite Aid 2016 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2016, February 28, 2015 and March 1, 2014

(In thousands, except per share amounts)

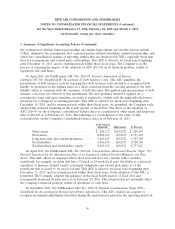

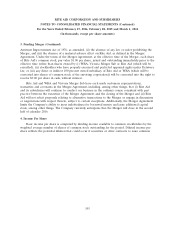

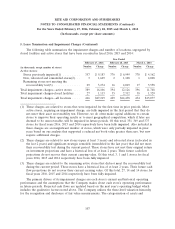

2. Acquisition (Continued)

financial statements were prepared. Accordingly, the allocation is subject to change and the impact of

such changes may be material.

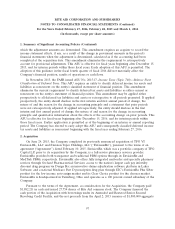

Preliminary purchase price

Cash consideration .................................................... $1,882,211

Stock consideration .................................................... 240,907

Total ............................................................. $2,123,118

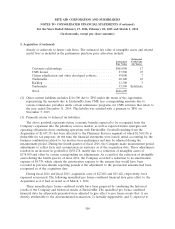

Preliminary purchase price allocation

Cash and cash equivalents ............................................... $ 103,834

Accounts receivable .................................................... 896,473

Inventories .......................................................... 7,276

Prepaid expenses and other current assets .................................... 13,386

Total current assets ................................................... 1,020,969

Property and equipment ................................................. 13,196

Intangible assets(1) .................................................... 646,600

Goodwill ............................................................ 1,637,351

Other assets ......................................................... 7,219

Total assets acquired .................................................. 3,325,335

Accounts payable ...................................................... 491,672

Reinsurance funds held ................................................. 381,225

Other current liabilities(2) ............................................... 216,937

Total current liabilities ................................................ 1,089,834

Other long term liabilities(3) ............................................. 112,383

Total liabilities assumed ............................................... 1,202,217

Net assets acquired ..................................................... $2,123,118

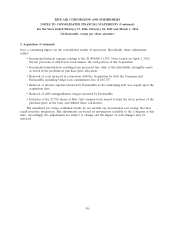

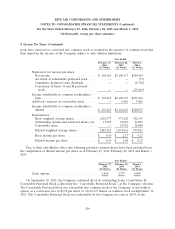

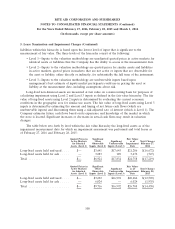

(1) Intangible assets are recorded at estimated fair value, as determined by management based on

available information which includes a preliminary valuation prepared by an independent third

party. The fair values assigned to identifiable intangible assets were determined through the use of

the income approach, specifically the relief from royalty and the multi-period excess earnings

methods. The major assumptions used in arriving at the estimated identifiable intangible asset

values included management’s preliminary estimates of future cash flows, discounted at an

appropriate rate of return which are based on the weighted average cost of capital for both the

Company and other market participants, projected customer attrition rates, as well as applicable

royalty rates for comparable assets. The useful lives for intangible assets were determined based

upon the remaining useful economic lives of the intangible assets that are expected to contribute

99