Rite Aid 2016 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2016, February 28, 2015 and March 1, 2014

(In thousands, except per share amounts)

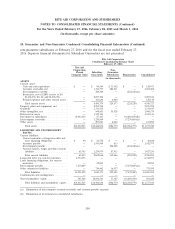

20. Segment Reporting (Continued)

respective segments. The CODM relies on internal management reporting that analyzes enterprise

results on certain key performance indicators, namely, revenues, gross profit, and Adjusted EBITDA.

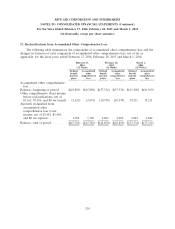

The following table is a reconciliation of the Company’s business segments to the consolidated

financial statements for the fiscal years ended February 27, 2016, February 28, 2015 and March 1, 2014:

Retail Pharmacy Intersegment

Pharmacy Services Eliminations(1) Consolidated

February 27, 2016:

Revenues .......................... $26,865,931 $4,103,513 $(232,787) $30,736,657

Gross Profit ........................ 7,595,429 230,826 — 7,826,255

Adjusted EBITDA(2) ................. 1,300,905 101,357 — 1,402,262

February 28, 2015:

Revenues .......................... $26,528,377 $ — $ — $26,528,377

Gross Profit ........................ 7,576,732 — — 7,576,732

Adjusted EBITDA(2) ................. 1,322,843 — — 1,322,843

March 1, 2014:

Revenues .......................... $25,526,413 $ — $ — $25,526,413

Gross Profit ........................ 7,323,734 — — 7,323,734

Adjusted EBITDA(2) ................. 1,324,959 — — 1,324,959

(1) Intersegment eliminations include intersegment revenues and corresponding cost of revenues that

occur when Pharmacy Services segment customers use Retail Pharmacy segment stores to purchase

covered products. When this occurs, both the Retail Pharmacy and Pharmacy Services segments

record the revenue on a stand-alone basis.

(2) See ‘‘Adjusted EBITDA, Adjusted Net Income, Adjusted Net Income per Diluted Share and Other

Non-GAAP Measures’’ in MD&A for additional details.

140