Rite Aid 2016 Annual Report Download - page 38

Download and view the complete annual report

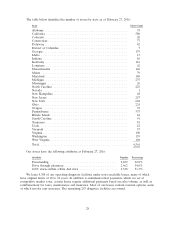

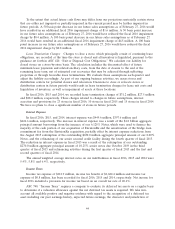

Please find page 38 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.conditions, including but not limited to (i) the expiration or earlier termination of the waiting period

under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, (ii) the absence of any

law or order prohibiting the Merger, and (iii) the absence of a material adverse effect on us, as defined

in the Merger Agreement. Under the terms of the Merger Agreement, at the effective time of the

Merger, each share of our common stock, par value $1.00 per share, issued and outstanding

immediately prior to the effective time (other than shares owned by (i) WBA, Victoria Merger Sub or

Rite Aid (which will be cancelled), (ii) stockholders who have properly exercised and perfected

appraisal rights under Delaware law, or (iii) any direct or indirect 100 percent owned subsidiary of Rite

Aid or WBA (which will be converted into shares of common stock of the surviving corporation)) will

be converted into the right to receive $9.00 per share in cash, without interest.

We, WBA and Victoria Merger Sub have each made customary representations, warranties and

covenants in the Merger Agreement, including, among other things, that (i) we and our subsidiaries will

continue to conduct our business in the ordinary course consistent with past practice between the

execution of the Merger Agreement and the closing of the Merger and (ii) we will not solicit proposals

relating to alternative transactions to the Merger or engage in discussions or negotiations with respect

thereto, subject to certain exceptions. Additionally, the Merger Agreement limits our ability to incur

indebtedness for borrowed money and issue additional capital stock, among other things. We currently

anticipate that the Merger will close in the second half of calendar 2016.

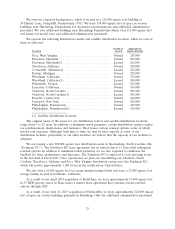

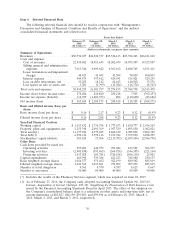

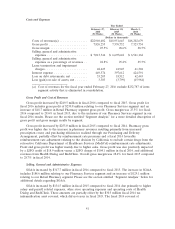

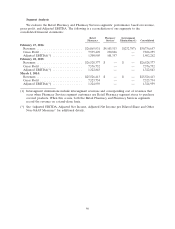

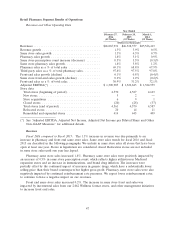

Overview of Financial Results

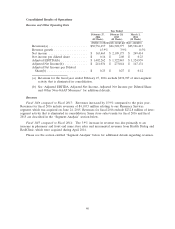

Net Income: Our net income for fiscal 2016 was $165.5 million or $0.16 per basic and diluted

share compared to net income for fiscal 2015 of $2,109.2 million or $2.17 per basic and $2.08 per

diluted share. The operating results for fiscal 2016 include the operating results of EnvisionRx

subsequent to the June 24, 2015 acquisition date. The decline in our operating results was driven

primarily by the prior year reduction of the deferred tax asset valuation allowance of $ 1,841.3 million,

or $1.80 per diluted share for fiscal 2015, which is further described in the ‘‘Income Taxes’’ section

below. Also contributing to the decline was higher depreciation and amortization related to our

acquisition of EnvisionRx and our increased capital spending, higher interest expense to fund the

acquisition of EnvisionRx, higher LIFO charges, loss on debt retirements and transaction costs related

to our acquisition of EnvisionRx and our pending Merger with WBA. These items were partially offset

by an increase in Adjusted EBITDA.

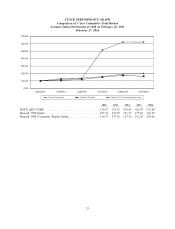

Adjusted EBITDA: Our Adjusted EBITDA for fiscal 2016 was $1,402.3 million or 4.6 percent of

revenues, compared to $1,322.8 million or 5.0 percent of revenues for fiscal year 2015. Adjusted

EBITDA for fiscal 2016 includes the Adjusted EBITDA of EnvisionRx subsequent to the June 24, 2015

acquisition date. The increase in Adjusted EBITDA was driven primarily by Pharmacy Services segment

Adjusted EBITDA of $101.4 million, partially offset by a decrease in Adjusted EBITDA of

$21.9 million by the Retail Pharmacy segment. The decrease in the Retail Pharmacy segment Adjusted

EBITDA was driven primarily by higher selling, general and administrative expenses and a decrease in

pharmacy gross profit, partially offset by an increase in front end gross profit. Please see the section

entitled ‘‘Segment Analysis’’ below for additional details regarding gross profit.

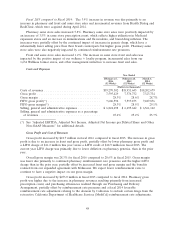

Revenues: Our revenue growth for fiscal 2016 was 15.9% compared to revenue growth of 3.9%

for fiscal 2015. Revenues for fiscal 2016 include revenues of $4,103.5 million, relating to our Pharmacy

Services segment. Fiscal 2016 revenues for our Retail Pharmacy segment were positively impacted by an

increase in same store sales and same store prescription count, partially offset by a negative impact

from generic introductions, lower reimbursement rates and store closings. In addition, revenues for

fiscal 2016 excludes $232.8 million of inter-segment activity that is eliminated in consolidation.

Gross Profit: Our gross profit was positively impacted by $230.8 million of gross profit relating to

our Pharmacy Services segment and an increase of $18.7 million from our Retail Pharmacy segment.

38