Rite Aid 2016 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2016, February 28, 2015 and March 1, 2014

(In thousands, except per share amounts)

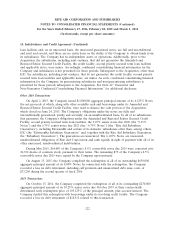

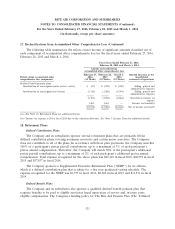

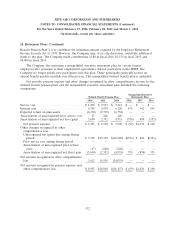

18. Retirement Plans (Continued)

Benefit Pension Plan’’) is to contribute the minimum amount required by the Employee Retirement

Income Security Act of 1974. However, the Company may, at its sole discretion, contribute additional

funds to the plan. The Company made contributions of $0 in fiscal 2016, $1,159 in fiscal 2015 and

$8,000 in fiscal 2014.

The Company also maintains a nonqualified executive retirement plan for certain former

employees who, pursuant to their employment agreements, did not participate in the SERP. The

Company no longer enrolls new participants into this plan. These participants generally receive an

annual benefit payable monthly over fifteen years. This nonqualified defined benefit plan is unfunded.

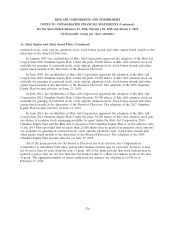

Net periodic pension expense and other changes recognized in other comprehensive income for the

defined benefit pension plans and the nonqualified executive retirement plan included the following

components:

Nonqualified Executive

Defined Benefit Pension Plan Retirement Plan

2016 2015 2014 2016 2015 2014

Service cost .......................... $1,498 $ 2,543 $ 3,341 $ — $ — $ —

Interest cost .......................... 6,398 6,474 6,120 475 542 541

Expected return on plan assets ............ (6,330) (7,339) (6,738) — — —

Amortization of unrecognized prior service cost 67 240 240 — — —

Amortization of unrecognized net loss (gain) . . 3,690 2,392 4,935 (574) 894 (351)

Net pension expense .................. $5,323 $ 4,310 $ 7,898 $ (99) $1,436 $ 190

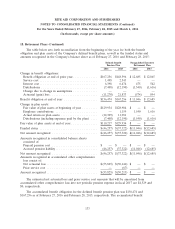

Other changes recognized in other

comprehensive loss:

Unrecognized net (gain) loss arising during

period ........................... $7,369 $17,190 $(18,860) $(574) $ 894 $(351)

Prior service cost arising during period ..... — — — — — —

Amortization of unrecognized prior service

costs ............................ (67) (240) (240) — — —

Amortization of unrecognized net (loss) gain (3,690) (2,392) (4,935) 574 (894) 351

Net amount recognized in other comprehensive

loss .............................. 3,612 14,558 (24,035) — — —

Net amount recognized in pension expense and

other comprehensive loss ............... $8,935 $18,868 $(16,137) $ (99) $1,436 $ 190

132