Rite Aid 2016 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We participate in the federal government’s Medicare Part D program as a PDP through our EIC

subsidiary. Our net revenues include insurance premiums earned by the PDP, which are determined

based on the PDP’s annual bid and related contractual arrangements with CMS. The insurance

premiums include a beneficiary premium, which is the responsibility of the PDP member, but is

subsidized by CMS in the case of low-income members, and a direct premium paid by CMS. Premiums

collected in advance are initially deferred as accrued expenses and are then recognized ratably as

revenue over the period in which members are entitled to receive benefits.

We have recorded estimates of various assets and liabilities arising from our participation in the

Medicare Part D program based on information in our claims management and enrollment systems.

Significant estimates arising from our participation in the Medicare Part D program include:

(i) estimates of low-income cost subsidy, reinsurance amounts and coverage gap discount amounts

ultimately payable to or receivable from CMS based on a detailed claims reconciliation, (ii) an estimate

of amounts receivable from CMS under a risk-sharing feature of the Medicare Part D program design,

referred to as the risk corridor and (iii) estimates for claims that have been reported and are in the

process of being paid or contested and for our estimate of claims that have been incurred but have not

yet been reported. Actual amounts of Medicare Part D-related assets and liabilities could differ

significantly from amounts recorded. Historically, the effect of these adjustments has not been material

to our results of operations or financial position.

Vendor allowances and purchase discounts for our Pharmacy Services segment: Our Pharmacy

Services segment receives purchase discounts on products purchased. Contractual arrangements with

vendors, including manufacturers, wholesalers and retail pharmacies, normally provide for the Pharmacy

Services segment to receive purchase discounts from established list prices in one, or a combination, of

the following forms: (i) a direct discount at the time of purchase or (ii) a discount (or rebate) paid

subsequent to dispensing when products are purchased indirectly from a manufacturer (e.g., through a

wholesaler or retail pharmacy). These rebates are recognized when prescriptions are dispensed and are

generally calculated and billed to manufacturers within 30 days of the end of each completed quarter.

Historically, the effect of adjustments resulting from the reconciliation of rebates recognized to the

amounts billed and collected has not been material to the results of operations. We account for the

effect of any such differences as a change in accounting estimate in the period the reconciliation is

completed. The Pharmacy Services segment also receives additional discounts under its wholesaler

contract. In addition, the Pharmacy Services segment receives fees from pharmaceutical manufacturers

for administrative services. Purchase discounts and administrative service fees are recorded as a

reduction of cost of revenues.

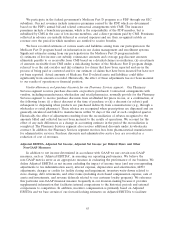

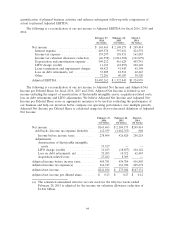

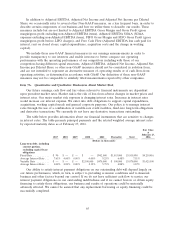

Adjusted EBITDA, Adjusted Net Income, Adjusted Net Income per Diluted Share and Other

Non-GAAP Measures

In addition to net income determined in accordance with GAAP, we use certain non-GAAP

measures, such as ‘‘Adjusted EBITDA’’, in assessing our operating performance. We believe the

non-GAAP metrics serve as an appropriate measure in evaluating the performance of our business. We

define Adjusted EBITDA as net income excluding the impact of income taxes (and any corresponding

adjustments to tax indemnification asset), interest expense, depreciation and amortization, LIFO

adjustments, charges or credits for facility closing and impairment, inventory write-downs related to

store closings, debt retirements, and other items (including stock-based compensation expense, sale of

assets and investments, and revenue deferrals related to our customer loyalty program). We reference

this particular non-GAAP financial measure frequently in our decision-making because it provides

supplemental information that facilitates internal comparisons to the historical periods and external

comparisons to competitors. In addition, incentive compensation is primarily based on Adjusted

EBITDA and we base certain of our forward-looking estimates on Adjusted EBITDA to facilitate

63