Rite Aid 2016 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2016, February 28, 2015 and March 1, 2014

(In thousands, except per share amounts)

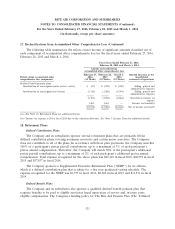

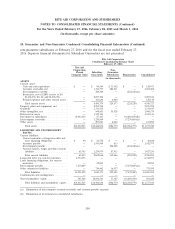

20. Segment Reporting (Continued)

The following is a reconciliation of net income to Adjusted EBITDA for fiscal 2016, 2015 and

2014:

February 27, February 28, March 1,

2016 2015 2014

(52 weeks) (52 weeks) (52 weeks)

Net income ......................... $ 165,465 $ 2,109,173 $ 249,414

Interest expense .................... 449,574 397,612 424,591

Income tax expense ................. 139,297 158,951 161,883

Income tax valuation allowance reduction . (26,358) (1,841,304) (161,079)

Depreciation and amortization expense . . . 509,212 416,628 403,741

LIFO charge (credit) ................ 11,163 (18,857) 104,142

Lease termination and impairment charges 48,423 41,945 41,304

Loss on debt retirements, net .......... 33,205 18,512 62,443

Other ........................... 72,281 40,183 38,520

Adjusted EBITDA .................... $1,402,262 $ 1,322,843 $1,324,959

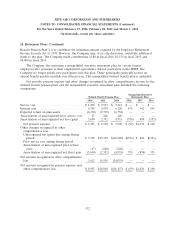

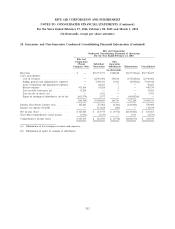

The following is balance sheet information for the Company’s reportable segments:

Retail Pharmacy

Pharmacy Services Eliminations(2) Consolidated

February 27, 2016:

Total Assets ......................... $8,468,186 $2,948,548 $(139,724) $11,277,010

Goodwill ........................... 76,124 1,637,351 — 1,713,475

Additions to property and equipment and

intangible assets .................... 667,719 2,276 — 669,995

February 28, 2015:

Total Assets ......................... $8,777,425 $ — $ — $ 8,777,425

Goodwill ........................... 76,124 — — 76,124

Additions to property and equipment and

intangible assets .................... 539,386 — — 539,386

(2) Intersegment eliminations include netting of the Pharmacy Services segment long-term deferred tax

liability of $116,027 against the Retail Pharmacy segment long-term deferred tax asset for

consolidation purposes in accordance with ASC 740, and intersegment accounts receivable of

$23,697, as of February 27, 2016, that represents amounts owed from the Pharmacy Services

segment to the Retail Pharmacy segment that are created when Pharmacy Services segment

customers use Retail Pharmacy segment stores to purchase covered products.

141