Rite Aid 2016 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2016, February 28, 2015 and March 1, 2014

(In thousands, except per share amounts)

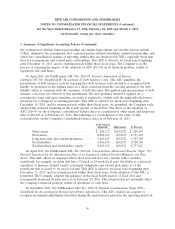

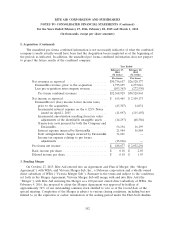

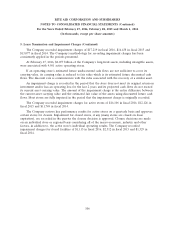

2. Acquisition (Continued)

The unaudited pro forma combined information is not necessarily indicative of what the combined

company’s results actually would have been had the Acquisition been completed as of the beginning of

the periods as indicated. In addition, the unaudited pro forma combined information does not purport

to project the future results of the combined company.

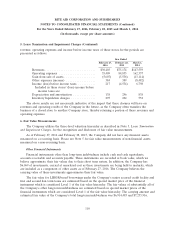

Year Ended

February 27, February 28,

2016 2015

(52 weeks) (52 weeks)

Pro forma Pro forma

Net revenues as reported ....................... $30,736,657 $26,528,377

EnvisionRx revenue, prior to the acquisition ........ 1,735,635 4,273,016

Less pre-acquisition intercompany revenue ......... (103,363) (272,530)

Pro forma combined revenues ................. $32,368,929 $30,528,863

Net income as reported ......................... $ 165,465 $ 2,109,173

EnvisionRx net (loss) income before income taxes,

prior to the acquisition ...................... (45,307) 14,031

Incremental interest expense on the 6.125% Notes

issued on April 2, 2015 .................... (11,097) (115,407)

Incremental amortization resulting from fair value

adjustments of the identifiable intangible assets . . (14,297) (48,586)

Transaction costs incurred by both the Company and

EnvisionRx ............................. 56,194 16,199

Interest expense incurred by EnvisionRx ......... 21,984 56,884

Debt extinguishment charges incurred by EnvisionRx 31,601 —

Income tax expense relating to pro forma

adjustments ............................ (15,866) —

Pro forma net income .......................... $ 188,677 $ 2,032,294

Basic income per share ......................... $ 0.18 $ 2.03

Diluted income per share ....................... $ 0.18 $ 1.95

3. Pending Merger

On October 27, 2015, Rite Aid entered into an Agreement and Plan of Merger (the ‘‘Merger

Agreement’’) with WBA, and Victoria Merger Sub, Inc., a Delaware corporation and a wholly owned

direct subsidiary of WBA (‘‘Victoria Merger Sub’’). Pursuant to the terms and subject to the conditions

set forth in the Merger Agreement, Victoria Merger Sub will merge with and into Rite Aid (the

‘‘Merger’’), with Rite Aid surviving the Merger as a 100 percent owned direct subsidiary of WBA. On

February 4, 2016, the proposal to adopt the Merger Agreement was approved by holders of

approximately 74% of our outstanding common stock entitled to vote as of the record date of the

special meeting. Completion of the Merger is subject to various closing conditions, including but not

limited to (i) the expiration or earlier termination of the waiting period under the Hart-Scott-Rodino

102