Rite Aid 2016 Annual Report Download - page 30

Download and view the complete annual report

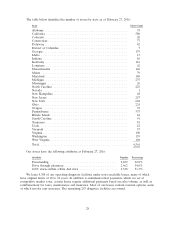

Please find page 30 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In addition, we own approximately 53,000 square feet of space in North Canton, Ohio for our mail

order and specialty drug facilities.

On a regular basis and as part of our normal business, we evaluate store performance and may

reduce in size, close or relocate a store if the store is redundant, underperforming or otherwise deemed

unsuitable. We also evaluate strategic dispositions and acquisitions of facilities and prescription files.

When we reduce in size, close or relocate a store or close distribution center facilities, we often

continue to have leasing obligations or own the property. We attempt to sublease this space. As of

February 27, 2016, we had 7,627,775 square feet of excess space, 4,032,304 square feet of which was

subleased.

Item 3. Legal Proceedings

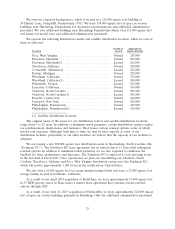

As of February 27, 2016, the Company was aware of ten (10) putative class action lawsuits that

were filed by purported Company stockholders, against the Company, its directors (the Individual

Defendants, together with the Company, the Rite Aid Defendants), Walgreens Boots Alliance, Inc.

(WBA) and Victoria Merger Sub Inc., (Victoria) challenging the transactions contemplated by the

Merger agreement between the Company and WBA. Eight (8) of these actions were filed in the Court

of Chancery of the State of Delaware (Smukler v. Rite Aid Corp., et al., Hirschler v. Standley, et al.,

Catelli v. Rite Aid Corp., et al., Orr v. Rite Aid Corp., et al., DePietro v. Standley, et al., Abadi v. Rite Aid

Corp., et al., Mortman v. Rite Aid Corp., et al., Sachs Investment Grp., et al. v. Standley, et al.). One

(1) action was filed in Pennsylvania in the Court of Common Pleas of Cumberland County

(Wilson v. Rite Aid Corp., et al.). The complaints in these nine (9) actions alleged primarily that the

Company’s directors breached their fiduciary duties by, among other things, agreeing to an allegedly

unfair and inadequate price, agreeing to deal protection devices that allegedly prevented the directors

from obtaining higher offers from other interested buyers for the Company and allegedly failing to

protect against certain purported conflicts of interest in connection with the Merger. The complaints

further alleged that the Company, WBA and/or Victoria aided and abetted these alleged breaches of

fiduciary duty. The complaints sought, among other things, to enjoin the closing of the Merger as well

as money damages and attorneys’ and experts’ fees.

On December 23, 2015, the eight (8) Delaware actions were consolidated in an action captioned In

re Rite Aid Corporation Stockholders Litigation, Consol. C.A. No. 11663-CB (the Consolidated Action).

In addition to the claims asserted in the nine (9) complaints discussed above, the operative pleading in

the Consolidated Action also included allegations that the preliminary proxy statement contained

material omissions, including with respect to the process that resulted in the Merger agreement and the

fairness opinion rendered by the Company’s banker. On December 28, 2015, the plaintiffs in the

Consolidated Action filed a motion for expedited proceedings, which the Court orally denied at a

hearing held on January 5, 2016. On March 11, 2016, the Court granted the plaintiffs’ notice and

proposed order voluntarily dismissing the Consolidated Action as moot, while retaining jurisdiction

solely for the purpose of adjudicating plaintiffs’ counsel’s anticipated application for an award of

attorneys’ fees and reimbursement of expenses. On April 15, 2016, the Company reached a settlement

in principle related to this matter for an immaterial amount.

A tenth action was filed in the United States District Court for the Middle District of Pennsylvania

(the Pennsylvania District Court) asserting a claim for violations of Section 14(a) of the Exchange Act

and SEC Rule 14a-9 against all defendants and a claim for violations of Section 20(a) of the Exchange

Act against the Individual Defendants and WBA (Herring v. Rite Aid Corp., et al.). The Herring

complaint alleges, among other things, that Rite Aid and its Board of Directors disseminated an

allegedly false and materially misleading proxy. The complaint sought to enjoin the shareholder vote on

the proposed Merger, a declaration that the proxy was materially false and misleading in violation of

federal securities laws, and an award of money damages and attorneys’ and experts’ fees. On

January 14 and 16, 2016, respectively, the plaintiff in the Herring action filed a motion for preliminary

30