Rite Aid 2016 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

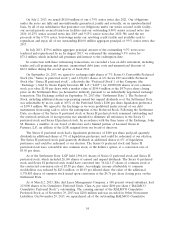

quantification of planned business activities and enhance subsequent follow-up with comparisons of

actual to planned Adjusted EBITDA.

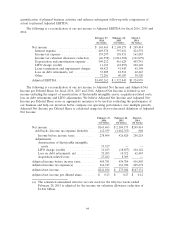

The following is a reconciliation of our net income to Adjusted EBITDA for fiscal 2016, 2015 and

2014:

February 27, February 28, March 1,

2016 2015 2014

(52 weeks) (52 weeks) (52 weeks)

Net income ......................... $ 165,465 $ 2,109,173 $ 249,414

Interest expense .................... 449,574 397,612 424,591

Income tax expense ................. 139,297 158,951 161,883

Income tax valuation allowance reduction . (26,358) (1,841,304) (161,079)

Depreciation and amortization expense . . . 509,212 416,628 403,741

LIFO charge (credit) ................ 11,163 (18,857) 104,142

Lease termination and impairment charges 48,423 41,945 41,304

Loss on debt retirements, net .......... 33,205 18,512 62,443

Other ........................... 72,281 40,183 38,520

Adjusted EBITDA .................... $1,402,262 $ 1,322,843 $1,324,959

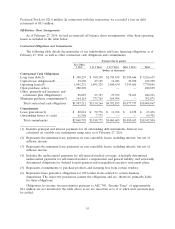

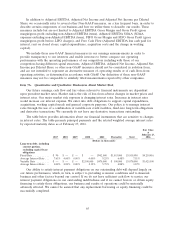

The following is a reconciliation of our net income to Adjusted Net Income and Adjusted Net

Income per Diluted Share for fiscal 2016, 2015 and 2014. Adjusted Net Income is defined as net

income excluding the impact of amortization of EnvisionRx intangible assets, acquisition-related costs,

loss on debt retirements and LIFO adjustments. We believe Adjusted Net Income and Adjusted Net

Income per Diluted Share serve as appropriate measures to be used in evaluating the performance of

our business and help our investors better compare our operating performance over multiple periods.

Adjusted Net Income per Diluted Share is calculated using our above-referenced definition of Adjusted

Net Income:

February 27, February 28, March 1,

2016 2015 2014

(52 weeks) (52 weeks) (52 weeks)

Net income .......................... $165,465 $ 2,109,173 $249,414

Add back—Income tax expense (benefit) . . . 112,939 (1,682,353) 804

Income before income taxes ........... 278,404 426,820 250,218

Adjustments:

Amortization of EnvisionRx intangible

assets .......................... 55,527 — —

LIFO charge (credit) ................ 11,163 (18,857) 104,142

Loss on debt retirements, net .......... 33,205 18,512 62,443

Acquisition-related costs .............. 27,482 8,309 —

Adjusted income before income taxes ....... 405,781 434,784 416,803

Adjusted income tax expense(a) ........... 164,747 161,740 269,672

Adjusted net income .................... $241,034 $ 273,044 $147,131

Adjusted net income per diluted share ....... $ 0.23 $ 0.27 $ 0.12

(a) The estimated annualized effective tax rate used for the fifty-two weeks ended

February 28, 2015 is adjusted for the income tax valuation allowance reduction of

$1.841 billion.

64