Rite Aid 2016 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2016, February 28, 2015 and March 1, 2014

(In thousands, except per share amounts)

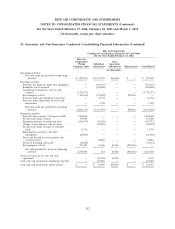

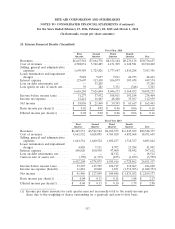

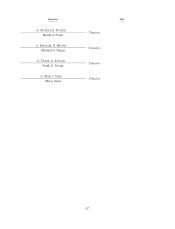

22. Supplementary Cash Flow Data

Year Ended

February 27, February 28, March 1,

2016 2015 2014

Cash paid for interest (net of capitalized amounts of $196, $145

and $197) ...................................... $ 403,727 $ 384,329 $ 414,692

Cash payments for income taxes, net ..................... $ 4,856 $ 6,665 $ 3,191

Equipment financed under capital leases .................. $ 9,614 $ 6,157 $ 18,065

Equipment received for noncash consideration ............. $ 3,011 $ 1,600 $ 2,825

Preferred stock dividends paid in additional shares .......... $ — $ — $ 8,318

Accrued capital expenditures .......................... $ 69,417 $ 87,916 $ 72,841

Gross borrowings from revolver ........................ $4,729,000 $6,078,000 $2,668,000

Gross repayments to revolver .......................... $4,354,000 $4,753,000 $2,933,000

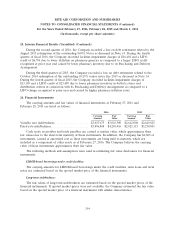

23. Related Party Transactions

There were receivables from related parties of $48 and $15 at February 27, 2016 and February 28,

2015, respectively.

As contemplated by the pending Merger with WBA, on December 31, 2015, the Board of

Directors of the Company approved the adoption of a retention and severance program upon the

recommendation of the Compensation Committee of the Board (the ‘‘Committee’’), which was advised

by the Committee’s independent compensation consultant, to enhance employee retention and

corporate performance through the closing of the Merger, and authorized the Company to enter into

individual retention award agreements with certain of its executive officers. The individual retention

award agreements provide for the lump-sum payment of the retention award on the one hundred

twentieth day following the closing of the Merger (the ‘‘retention date’’), subject to continued

employment through such retention date or upon the earlier termination of the recipient’s employment

by the Company without ‘‘cause’’ or by the recipient for ‘‘good reason’’ (as such terms are defined in

the Company’s 2014 Omnibus Equity Plan) (each referred to as a ‘‘qualifying termination’’). The

Company executed retention award agreements on December 31, 2015 with certain Company executive

officers, which provided for the grant of retention awards under the terms described above and, for tax

planning purposes, provide for the accelerated payment of the executive’s fiscal year 2016 bonus in

2015, the accelerated lapse of restrictions on certain time-based restricted stock awards in 2015 and, to

the extent necessary for one executive officer, the accelerated payment of the retention award in 2015,

in each case subject to repayment requirements on the part of the executive if the executive would not

have otherwise become entitled to such payments. During fiscal 2016, the Company made advance

payments to certain executives of $500 for retention bonuses and $1,778 of fiscal 2016 performance

bonuses for tax planning purposes.

147