Rite Aid 2016 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2016, February 28, 2015 and March 1, 2014

(In thousands, except per share amounts)

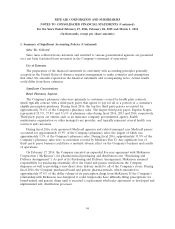

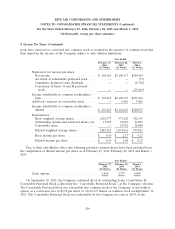

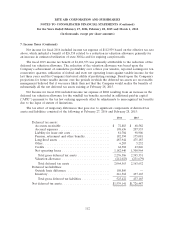

4. Income Per Share (Continued)

stock were exercised or converted into common stock or resulted in the issuance of common stock that

then shared in the income of the Company subject to anti- dilution limitations.

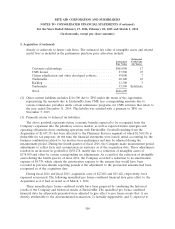

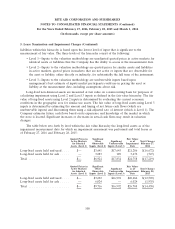

Year Ended

February 27, February 28, March 1,

2016 2015 2014

(52 Weeks) (52 Weeks) (52 Weeks)

Numerator for income per share:

Net income ......................... $ 165,465 $2,109,173 $249,414

Accretion of redeemable preferred stock . . . . — — (77)

Cumulative preferred stock dividends ...... — — (8,318)

Conversion of Series G and H preferred

stock ............................ — — (25,603)

Income attributable to common stockholders—

basic .............................. $ 165,465 $2,109,173 $215,416

Add back—interest on convertible notes ...... — 5,456 5,456

Income attributable to common stockholders—

diluted ............................ $ 165,465 $2,114,629 $220,872

Denominator:

Basic weighted average shares ........... 1,024,377 971,102 922,199

Outstanding options and restricted shares, net 17,985 21,967 32,093

Convertible notes ..................... — 24,792 24,800

Diluted weighted average shares .......... 1,042,362 1,017,861 979,092

Basic income per share ................ $ 0.16 $ 2.17 $ 0.23

Diluted income per share ............... $ 0.16 $ 2.08 $ 0.23

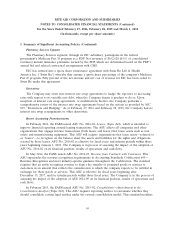

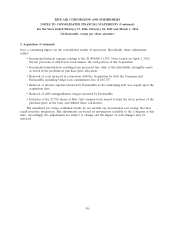

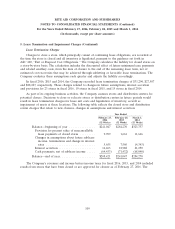

Due to their anti-dilutive effect, the following potential common shares have been excluded from

the computation of diluted income per share as of February 27, 2016, February 28, 2015 and March 1,

2014:

Year Ended

February 27, February 28, March 1,

2016 2015 2014

(52 Weeks) (52 Weeks) (52 Weeks)

Stock options ......................... 3,464 2,777 4,044

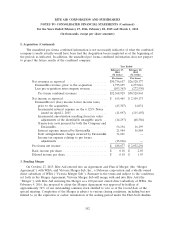

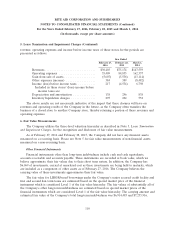

On September 30, 2013, the Company redeemed all of its outstanding Series G and Series H

Convertible Preferred Stock (collectively the ‘‘Convertible Preferred Stock’’) at the Company’s election.

The Convertible Preferred Stock was convertible into common stock of the Company, at the holder’s

option, at a conversion rate of $5.50 per share or 34,621,117 shares of common stock on September 30,

2013. The Convertible Preferred Stock was redeemable by the Company for cash at 105% of the

104