Rite Aid 2016 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2016, February 28, 2015 and March 1, 2014

(In thousands, except per share amounts)

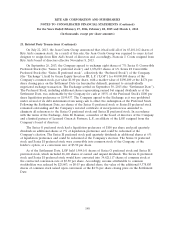

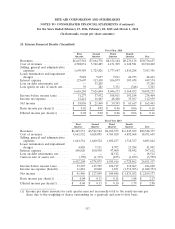

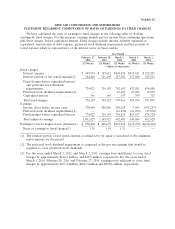

25. Interim Financial Results (Unaudited) (Continued)

During the second quarter of 2016, the Company recorded a loss on debt retirement related to the

August 2015 redemption of the outstanding 8.00% Notes as discussed in Note 14. During the fourth

quarter of fiscal 2016, the Company recorded facilities impairment charges of $16,401 and a LIFO

credit of $6,796 due to lower deflation on pharmacy generics as compared to a larger LIFO credit

recognized at prior year end caused by lower pharmacy inventory due to its Purchasing and Delivery

Arrangement.

During the third quarter of 2015, the Company recorded a loss on debt retirement related to the

October 2014 redemption of the outstanding 10.25% senior notes due 2019 as discussed in Note 14.

During the fourth quarter of fiscal 2015, the Company recorded facilities impairment charges of

$13,105 and a LIFO credit of $23,489 due to lower pharmacy inventory in both its stores and

distribution centers in connection with its Purchasing and Delivery Arrangement as compared to a

LIFO charge recognized at prior year end caused by higher pharmacy inflation rates.

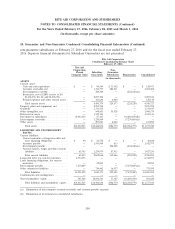

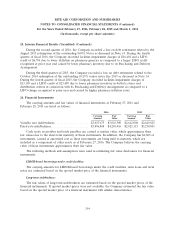

26. Financial Instruments

The carrying amounts and fair values of financial instruments at February 27, 2016 and

February 28, 2015 are listed as follows:

2016 2015

Carrying Fair Carrying Fair

Amount Value Amount Value

Variable rate indebtedness ................... $3,027,675 $3,025,500 $2,642,008 $2,649,825

Fixed rate indebtedness ..................... $3,886,808 $4,210,416 $2,825,115 $3,230,801

Cash, trade receivables and trade payables are carried at market value, which approximates their

fair values due to the short-term maturity of these instruments. In addition, the Company has $6,069 of

investments, carried at amortized cost as these investments are being held to maturity, which are

included as a component of other assets as of February 27, 2016. The Company believes the carrying

value of these investments approximates their fair value.

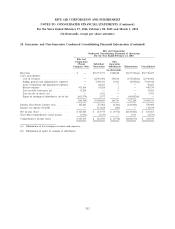

The following methods and assumptions were used in estimating fair value disclosures for financial

instruments:

LIBOR-based borrowings under credit facilities:

The carrying amounts for LIBOR-based borrowings under the credit facilities, term loans and term

notes are estimated based on the quoted market price of the financial instruments.

Long-term indebtedness:

The fair values of long-term indebtedness are estimated based on the quoted market prices of the

financial instruments. If quoted market prices were not available, the Company estimated the fair value

based on the quoted market price of a financial instrument with similar characteristics.

154