Rite Aid 2016 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2016, February 28, 2015 and March 1, 2014

(In thousands, except per share amounts)

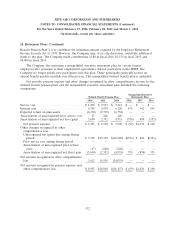

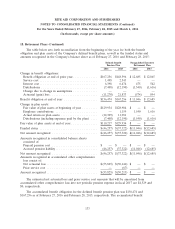

18. Retirement Plans (Continued)

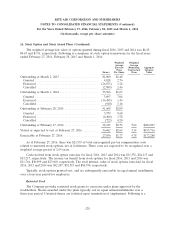

Following are the future benefit payments expected to be paid for the Defined Benefit Pension

Plan and the nonqualified executive retirement plan during the years indicated:

Nonqualified

Defined Benefit Executive

Fiscal Year Pension Plan Retirement Plan

2017 ..................................... $ 7,971 $1,602

2018 ..................................... 8,153 1,234

2019 ..................................... 8,134 1,209

2020 ..................................... 8,332 1,129

2021 ..................................... 8,495 961

2022 - 2026 ............................... 44,253 3,818

Total ................................... $85,338 $9,953

Other Plans

The Company participates in various multi-employer union pension plans that are not sponsored

by the Company. Total expenses recognized for the multi-employer plans were $25,966 in fiscal 2016,

$24,261 in fiscal 2015 and $26,617 in fiscal 2014.

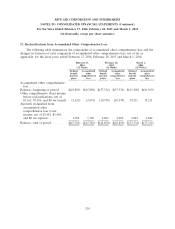

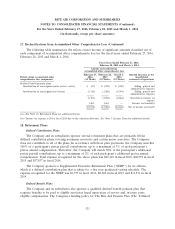

19. Multiemployer Plans that Provide Pension Benefits

The Company contributes to a number of multiemployer defined benefit pension plans under the

terms of collective-bargaining agreements that cover certain of its union-represented employees. The

risks of participating in these multiemployer plans are different from single-employer plans. Assets

contributed to the multiemployer plan by one employer may be used to provide benefits to employees

of other participating employers. If a participating employer stops contributing to the plan, the

unfunded obligations of the plan may be borne by the remaining participating employers. Additionally,

if the Company chooses to stop participating in some of its multiemployer plans, the Company may be

required to pay those plans an amount based on the underfunded status of the plan, referred to as a

withdrawal liability.

The Company’s participation in these plans for the annual period ended February 27, 2016 is

outlined in the table below. The ‘‘EIN/Pension Plan Number’’ column provides the Employer

Identification Number (EIN) and the three- digit plan number, if applicable. The most recent Pension

Protection Act (PPA) zone status available for fiscal 2016 and fiscal 2015 is for the plan year- ends as

indicated below. The zone status is based on information that the Company received from the plan and

is certified by the plan’s actuary. Among other factors, plans in the red zone are generally less than

65 percent funded, plans in the yellow zone are less than 80 percent funded, and plans in the green

zone are at least 80 percent funded. The ‘‘FIP/RP Status Pending/Implemented’’ column indicates plans

for which a financial improvement plan (FIP) or a rehabilitation plan (RP) is either pending or has

been implemented. In addition to regular plan contributions, the Company may be subject to a

surcharge if the plan is in the red zone. The ‘‘Surcharge Imposed’’ column indicates whether a

surcharge has been imposed on contributions to the plan. The last two columns list the expiration

137