Rite Aid 2016 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

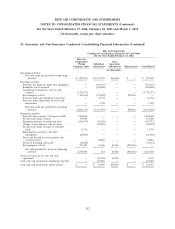

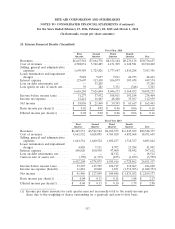

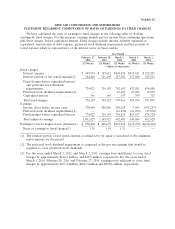

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2016, February 28, 2015 and March 1, 2014

(In thousands, except per share amounts)

24. Guarantor and Non-Guarantor Condensed Consolidating Financial Information (Continued)

Rite Aid Corporation

Condensed Consolidating Statement of Cash Flows

For the Year Ended February 27, 2016

Rite Aid

Corporation Non-

(Parent Subsidiary Guarantor

Company Only) Guarantors Subsidiaries Eliminations Consolidated

(in thousands)

Operating activities:

Net cash (used in) provided by operating

activities .................... $ (387,871) $ 1,391,759 $(6,486) $ — $ 997,402

Investing activities:

Payments for property, plant and equipment . — (541,347) — — (541,347)

Intangible assets acquired ............ — (128,648) — — (128,648)

Acquisition of businesses, net of cash

acquired ...................... (1,778,377) — — — (1,778,377)

Intercompany activity ............... (103,834) (794,422) — 898,256 —

Proceeds from sale-leaseback transaction . . . — 36,732 — — 36,732

Proceeds from dispositions of assets and

investments .................... — 9,782 — — 9,782

Net cash (used in) provided by investing

activities .................... (1,882,211) (1,417,903) — 898,256 (2,401,858)

Financing activities:

Proceeds from issuance of long-term debt . . 1,800,000 — — — 1,800,000

Net proceeds from revolver ........... 375,000 — — — 375,000

Principal payments on long-term debt ..... (650,079) (22,638) — — (672,717)

Change in zero balance cash accounts ..... — (62,878) — — (62,878)

Net proceeds from issuance of common

stock ........................ 11,376 — — — 11,376

Financing fees paid for early debt

redemption .................... (26,003) — — — (26,003)

Excess tax benefit on stock options and

restricted stock .................. — 22,884 — — 22,884

Deferred financing costs paid .......... (34,634) — — — (34,634)

Intercompany activity ............... 794,422 63,446 40,388 (898,256) —

Net cash provided by (used in) financing

activities .................... 2,270,082 814 40,388 (898,256) 1,413,028

(Decrease) increase in cash and cash

equivalents ...................... — (25,330) 33,902 — 8,572

Cash and cash equivalents, beginning of period — 115,899 — — 115,899

Cash and cash equivalents, end of period .... $ — $ 90,569 $33,902 $ — $ 124,471

152