Rite Aid 2016 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2016, February 28, 2015 and March 1, 2014

(In thousands, except per share amounts)

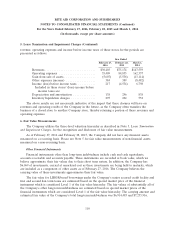

7. Income Taxes (Continued)

Net income for fiscal 2016 included income tax expense of $112,939 based on the effective tax rate

above, which included a benefit of $26,358 related to a reduction in valuation allowance primarily for

an increase in estimated utilization of state NOLs and for expiring carryforwards.

The fiscal 2015 income tax benefit of $1,682,353 was primarily attributable to the reduction of the

deferred tax valuation allowance. The reduction of the valuation allowance was based upon the

Company’s achievement of cumulative profitability over a three year window, reported earnings for ten

consecutive quarters, utilization of federal and state net operating losses against taxable income for the

last three years and the Company’s historical ability of predicting earnings. Based upon the Company’s

projections for future taxable income over the periods in which the deferred tax assets are recoverable,

management believed that it was more likely than not that the Company would realize the benefits of

substantially all the net deferred tax assets existing at February 28, 2015.

Net Income for fiscal 2014 included income tax expense of $804 resulting from an increase in the

deferred tax valuation allowance for the windfall tax benefits recorded in additional paid-in capital

(‘‘APIC’’) pursuant to the tax law ordering approach offset by adjustments to unrecognized tax benefits

due to the lapse of statute of limitations.

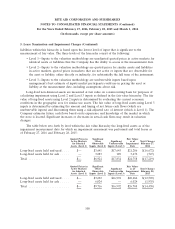

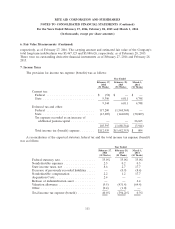

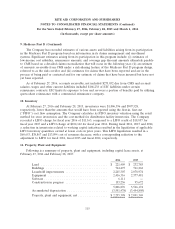

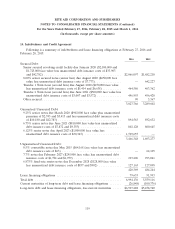

The tax effect of temporary differences that gave rise to significant components of deferred tax

assets and liabilities consisted of the following at February 27, 2016 and February 28, 2015:

2016 2015

Deferred tax assets:

Accounts receivable ........................... $ 72,883 $ 68,582

Accrued expenses ............................. 198,636 207,553

Liability for lease exit costs ...................... 81,704 98,906

Pension, retirement and other benefits .............. 182,394 175,081

Long-lived assets ............................. 487,944 475,187

Other ...................................... 6,203 5,232

Credits ..................................... 64,382 63,826

Net operating losses ........................... 1,182,440 1,300,964

Total gross deferred tax assets .................. 2,276,586 2,395,331

Valuation allowance ........................... (212,023) (231,679)

Total deferred tax assets ...................... 2,064,563 2,163,652

Deferred tax liabilities:

Outside basis difference ........................ 108,860 —

Inventory ................................... 416,562 437,165

Total gross deferred tax liabilities ................ 525,422 437,165

Net deferred tax assets ........................... $1,539,141 $1,726,487

112