Rite Aid 2016 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2016, February 28, 2015 and March 1, 2014

(In thousands, except per share amounts)

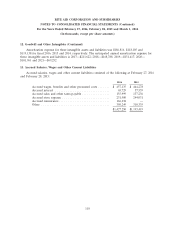

6. Fair Value Measurements (Continued)

respectively, as of February 27, 2016. The carrying amount and estimated fair value of the Company’s

total long-term indebtedness was $5,467,123 and $5,880,626, respectively, as of February 28, 2015.

There were no outstanding derivative financial instruments as of February 27, 2016 and February 28,

2015.

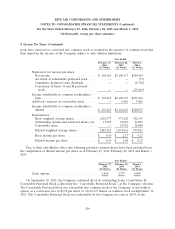

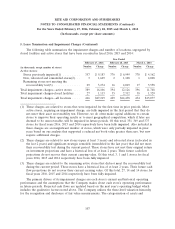

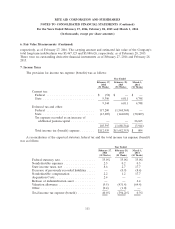

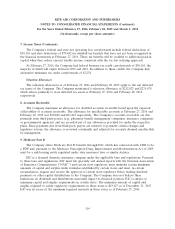

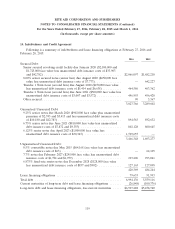

7. Income Taxes

The provision for income tax expense (benefit) was as follows:

Year Ended

February 27, February 28, March 1,

2016 2015 2014

(52 Weeks) (52 Weeks) (52 Weeks)

Current tax:

Federal ........................... $ (52) $ — $ —

State ............................. 9,396 6,011 4,748

9,344 6,011 4,748

Deferred tax and other:

Federal ........................... 117,200 (1,544,344) —

State ............................. (13,605) (144,020) (30,609)

Tax expense recorded as an increase of

additional paid-in-capital ............. — — 26,665

103,595 (1,688,364) (3,944)

Total income tax (benefit) expense ........ $112,939 $(1,682,353) $ 804

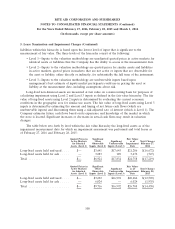

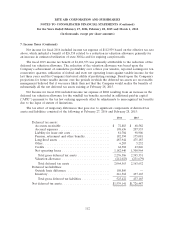

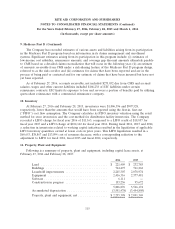

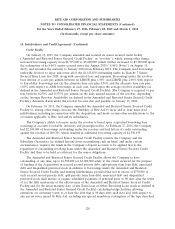

A reconciliation of the expected statutory federal tax and the total income tax expense (benefit)

was as follows:

Year Ended

February 27, February 28, March 1,

2016 2015 2014

(52 Weeks) (52 Weeks) (52 Weeks)

Federal statutory rate .................... 35.0% 35.0% 35.0%

Nondeductible expenses .................. 2.3 0.2 0.3

State income taxes, net .................. 8.6 2.7 17.7

Decrease of previously recorded liabilities ..... — (0.9) (8.4)

Nondeductible compensation .............. 2.2 1.2 17.7

Acquisition Costs ....................... 2.4 — —

Release of indemnification asset ............ — — 2.4

Valuation allowance ..................... (9.5) (431.4) (64.4)

Other ............................... (0.4) (1.0) —

Total income tax expense (benefit) .......... 40.6% (394.2)% 0.3%

111