Rite Aid 2016 Annual Report Download - page 50

Download and view the complete annual report

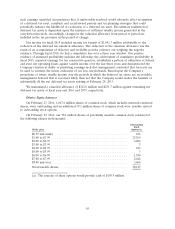

Please find page 50 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Pursuant to the terms of the Agreement, as consideration for the acquisition of EnvisionRx (the

‘‘Acquisition’’), we paid $1,882.2 million in cash, after giving effect to certain adjustments, and issued

27,754,000 shares of Rite Aid common stock. At closing, $15.0 million of the cash purchase price was

placed into an adjustment escrow account. Rite Aid and Shareholder Representative Services LLC

(‘‘SRS’’) entered into a Final Adjustment Amount Resolution Agreement and Release on November 5,

2015, pursuant to which (i) $1.2 million was released from the adjustment escrow account to Rite Aid

and (ii) $13.8 million, constituting the remainder of the funds in the adjustment escrow account and all

investment earnings and income on the funds held in the adjustment escrow account, was released to

SRS on behalf of the sellers. The escrow agent distributed the funds in accordance with the agreement

between the parties. We financed the cash portion of the Acquisition with borrowings under our Senior

Secured Credit Facility and the net proceeds from the April 2, 2015 issuance of $1.8 billion aggregate

principal amount of 6.125% senior notes due 2023 (the ‘‘6.125% Notes’’). The consideration associated

with the common stock was $240.9 million based on a stock price of $8.68 per share, representing the

closing price of Rite Aid common stock on the date of the Acquisition. In addition, following the

closing, we were obligated to pay the former owners of EnvisionRx their pro rata share of the

settlement payment to be received by EnvisionRx from the Centers of Medicare and Medicaid Services

(‘‘CMS’’) for the 2014 plan year, net of amounts due to EnvisionRx’ reinsurer. The settlement payment

of approximately $116.1 million was made on November 5, 2015. The purchase accounting for the

Acquisition has not yet been finalized, and the impact of the changes on our financial statements may

be material.

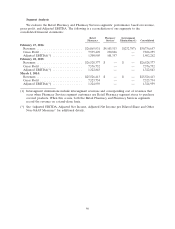

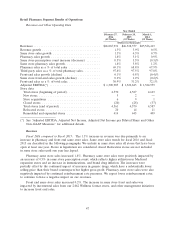

Pharmacy Services Segment Results of Operations

Pharmacy Services segment revenue for fiscal 2016 was $4,103.5 million. Pharmacy Services

Adjusted EBITDA for fiscal 2016 was $101.4 million or 2.5 percent of Pharmacy Services revenue. In

addition, gross profit and gross margin for fiscal 2016 was $230.8 million or 5.6%, respectively, for our

Pharmacy Services segment. Pharmacy Services segment selling, general and administrative expenses for

fiscal 2016 were $188.6 million. Revenues and gross profit for fiscal 2016 were positively impacted by

mid-year customer additions, partially offset by increased selling, general and administrative expenses

for the year as a result of ramp up costs due to the onboarding of new PBM customers.

As our core PBM business grows, added opportunities are created for our Envision mail and

specialty pharmacies. With specialty drugs expected to comprise 50% of all prescription spending by

2018, our specialty pharmacy is being embraced by more clients and has seen a 26% increase in

monthly prescription volume over the past eight months.

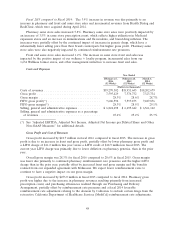

In addition, based on preliminary 2016 benchmark results received from CMS, the Envision

Insurance Company will retain 14 of 34 CMS regions, which compares to 24 regions in 2015. With the

annual Part D bidding process becoming increasingly price competitive, we are maintaining a focus on

acquiring low income subsidy and chooser members at a premium level that is profitable and ensures

the continued delivery of attractive benefits and satisfying service. While we are decreasing in

geographies and anticipate a reduction in covered lives of approximately 30,000, we have approximately

365,000 individual Medicare Part D program Prescription Drug Plan (‘‘PDP’’) lives as of February 27,

2016 and increased membership in the Rite Aid retail footprint.

Liquidity and Capital Resources

General

We have two primary sources of liquidity: (i) cash provided by operating activities and

(ii) borrowings under our Amended and Restated Senior Secured Credit Facility. Our principal uses of

cash are to provide working capital for operations, to service our obligations to pay interest and

principal on debt and to fund capital expenditures. Total liquidity as of February 27, 2016 was

50