Rite Aid 2016 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2016, February 28, 2015 and March 1, 2014

(In thousands, except per share amounts)

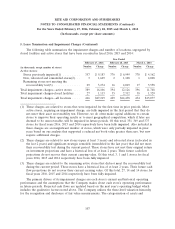

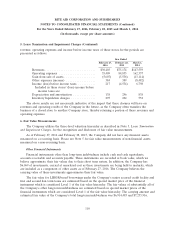

5. Lease Termination and Impairment Charges (Continued)

liabilities within this hierarchy is based upon the lowest level of input that is significant to the

measurement of fair value. The three levels of the hierarchy consist of the following:

• Level 1—Inputs to the valuation methodology are unadjusted quoted prices in active markets for

identical assets or liabilities that the Company has the ability to access at the measurement date.

• Level 2—Inputs to the valuation methodology are quoted prices for similar assets and liabilities

in active markets, quoted prices in markets that are not active or inputs that are observable for

the asset or liability, either directly or indirectly, for substantially the full term of the instrument.

• Level 3—Inputs to the valuation methodology are unobservable inputs based upon

management’s best estimate of inputs market participants could use in pricing the asset or

liability at the measurement date, including assumptions about risk.

Long-lived non-financial assets are measured at fair value on a nonrecurring basis for purposes of

calculating impairment using Level 2 and Level 3 inputs as defined in the fair value hierarchy. The fair

value of long-lived assets using Level 2 inputs is determined by evaluating the current economic

conditions in the geographic area for similar use assets. The fair value of long-lived assets using Level 3

inputs is determined by estimating the amount and timing of net future cash flows (which are

unobservable inputs) and discounting them using a risk-adjusted rate of interest (which is Level 1). The

Company estimates future cash flows based on its experience and knowledge of the market in which

the store is located. Significant increases or decreases in actual cash flows may result in valuation

changes.

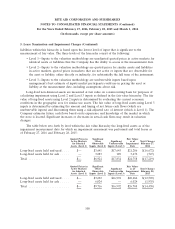

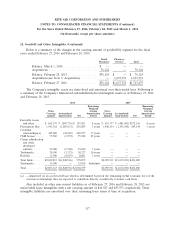

The table below sets forth by level within the fair value hierarchy the long-lived assets as of the

impairment measurement date for which an impairment assessment was performed and total losses as

of February 27, 2016 and February 28, 2015:

Quoted Prices in Significant Fair Values

Active Markets Other Significant as of Total Charges

for Identical Observable Unobservable Impairment February 27,

Assets (Level 1) Inputs (Level 2) Inputs (Level 3) Date 2016

Long-lived assets held and used .... $— $3,641 $17,645 $21,286 $(16,672)

Long-lived assets held for sale ..... — 3,283 189 3,472 (547)

Total ....................... $— $6,924 $17,834 $24,758 $(17,219)

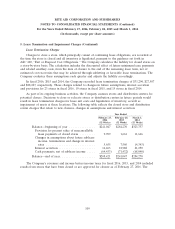

Quoted Prices in Significant Fair Values

Active Markets Other Significant as of Total Charges

for Identical Observable Unobservable Impairment February 28,

Assets (Level 1) Inputs (Level 2) Inputs (Level 3) Date 2015

Long-lived assets held and used .... $— $3,692 $16,992 $20,684 $(12,503)

Long-lived assets held for sale ..... — 6,024 — 6,024 (1,935)

Total ....................... $— $9,716 $16,992 $26,708 $(14,438)

108