Rite Aid 2016 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

such earnings, unsettled circumstances that, if unfavorably resolved, would adversely affect recognition

of a deferred tax asset, carryback and carryforward periods and tax planning strategies that could

potentially enhance the likelihood of realization of a deferred tax asset. The ultimate realization of

deferred tax assets is dependent upon the existence of sufficient taxable income generated in the

carryforward periods. Accordingly, changes in the valuation allowance from period to period are

included in the tax provision in the period of change.

Net income for fiscal 2015 included income tax benefit of $1,841.3 million attributable to the

reduction of the deferred tax valuation allowance. The reduction of the valuation allowance was the

result of an accumulation of objective and verifiable positive evidence out weighing the negative

evidence. Through fiscal 2014, we had a cumulative loss over a three year window. Our positive

evidence of sustained profitability includes the following: the achievement of cumulative profitability in

fiscal 2015, reported earnings for ten consecutive quarters, established a pattern of utilization of federal

and state net operating losses against taxable income over the last three years and demonstrated the

Company’s historical ability of predicting earnings such that management concluded that forecasts can

be used to estimate the future utilization of our loss carryforwards. Based upon the Company’s

projections of future taxable income over the periods in which the deferred tax assets are recoverable,

management believed that it was more likely than not that the Company would realize the benefits of

substantially all the net deferred tax assets existing at February 28, 2015.

We maintained a valuation allowance of $212.0 million and $231.7 million against remaining net

deferred tax assets at fiscal year-end 2016 and 2015, respectively.

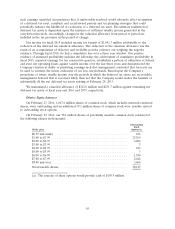

Dilutive Equity Issuances

On February 27, 2016, 1,047.8 million shares of common stock, which includes unvested restricted

shares, were outstanding and an additional 38.1 million shares of common stock were issuable related

to outstanding stock options.

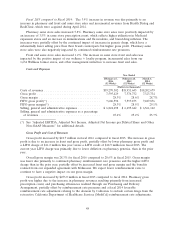

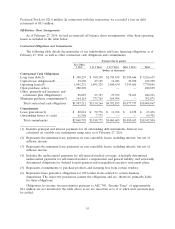

On February 27, 2016, our 38.1 million shares of potentially issuable common stock consisted of

the following (shares in thousands):

Outstanding

Stock

Strike price Options(a)

$0.99 and under ......................................... 654

$1.00 to $1.99 ........................................... 25,369

$2.00 to $2.99 ........................................... 4,006

$3.00 to $3.99 ........................................... 3

$4.00 to $4.99 ........................................... 434

$5.00 to $5.99 ........................................... 3

$6.00 to $6.99 ........................................... 1,550

$7.00 to $7.99 ........................................... 2,642

$8.00 and over ........................................... 3,464

Total issuable shares ...................................... 38,125

(a) The exercise of these options would provide cash of $103.9 million.

45