Quest Diagnostics 2006 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2006 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

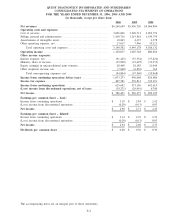

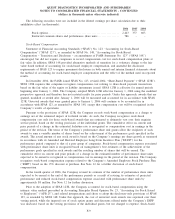

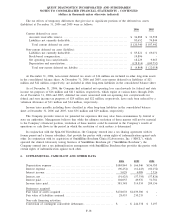

compensation expense recorded in accordance with APB 25, relating to restricted stock awards, was $2.0 million

and $1.4 million in 2005 and 2004, respectively.

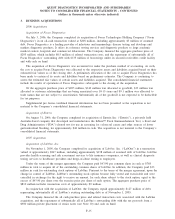

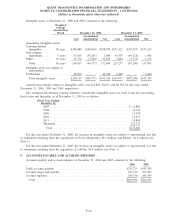

The Company has several stock ownership and compensation plans, which are described more fully in Note

12. The following pro forma information is presented for comparative purposes and illustrates the pro forma

effect on net income and earnings per share for the periods presented, as if the Company had elected to

recognize compensation cost associated with stock option awards and employee stock purchases under the

Company’s ESPP, consistent with the method prescribed by SFAS 123, as amended by SFAS 148 (in thousands,

except per share data):

2005 2004

Net income:

Net income, as reported.............................................. $546,277 $499,195

Add: Stock-based compensation under APB 25 . ....................... 2,037 1,384

Deduct: Total stock-based compensation expense determined under fair

value method for all awards, net of related tax effects. .............. (32,623) (43,710)

Pro forma net income................................................ $515,691 $456,869

Earnings per common share:

Basic – as reported .................................................. $ 2.71 $ 2.45

Basic – pro forma ................................................... $ 2.56 $ 2.23

Diluted – as reported ................................................ $ 2.66 $ 2.35

Diluted – pro forma ................................................. $ 2.50 $ 2.13

Foreign Currency

Assets and liabilities of foreign subsidiaries are translated into U.S. dollars at year-end exchange rates.

Income and expense items are translated at average exchange rates prevailing during the year. The translation

adjustments are recorded as a component of accumulated other comprehensive income within stockholders’

equity. Gains and losses from foreign currency transactions are included within “other operating expense, net” in

the consolidated statements of operations. Transaction gains and losses have not been material.

Cash and Cash Equivalents

Cash and cash equivalents include all highly-liquid investments with maturities, at the time acquired by the

Company, of three months or less.

Concentration of Credit Risk

Financial instruments that potentially subject the Company to concentrations of credit risk are principally

cash, cash equivalents, short-term investments and accounts receivable. The Company’s policy is to place its

cash, cash equivalents and short-term investments in highly rated financial instruments and institutions.

Concentration of credit risk with respect to accounts receivable is mitigated by the diversity of the Company’s

clients and their dispersion across many different geographic regions, and is limited to certain customers who are

large buyers of the Company’s services. To reduce risk, the Company routinely assesses the financial strength of

these customers and, consequently, believes that its accounts receivable credit risk exposure, with respect to these

customers, is limited. While the Company has receivables due from federal and state governmental agencies, the

Company does not believe that such receivables represent a credit risk since the related healthcare programs are

funded by federal and state governments, and payment is primarily dependent on submitting appropriate

documentation.

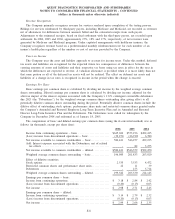

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are reported at realizable value, net of allowances for doubtful accounts, which is

estimated and recorded in the period the related revenue is recorded. The Company has implemented a

F-10

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)