Quest Diagnostics 2006 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2006 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

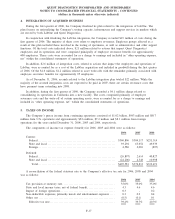

4. INTEGRATION OF ACQUIRED BUSINESS

During the first quarter of 2006, the Company finalized its plan related to the integration of LabOne. The

plan focuses on rationalizing the Company’s testing capacity, infrastructure and support services in markets which

are served by both LabOne and Quest Diagnostics.

In conjunction with finalizing the LabOne integration, the Company recorded $23 million of costs during the

first quarter of 2006. The majority of these costs relate to employee severance. Employee groups affected as a

result of this plan included those involved in the testing of specimens, as well as administrative and other support

functions. Of the total costs indicated above, $21 million related to actions that impact Quest Diagnostics’

employees and its operations and were comprised principally of employee severance benefits for approximately

600 employees. These costs were accounted for as a charge to earnings and included in “other operating expense,

net” within the consolidated statements of operations.

In addition, $2.6 million of integration costs, related to actions that impact the employees and operations of

LabOne, were accounted for as a cost of the LabOne acquisition and included in goodwill during the first quarter

of 2006. Of the $2.6 million, $1.2 million related to asset write-offs with the remainder primarily associated with

employee severance benefits for approximately 95 employees.

As of December 31, 2006, accruals related to the LabOne integration plan totaled $22 million. While the

majority of the accrued integration costs are expected to be paid in 2007, there are certain severance costs that

have payment terms extending into 2008.

In addition, during the first quarter of 2006, the Company recorded a $4.1 million charge related to

consolidating its operations in California into a new facility. The costs, comprised primarily of employee

severance costs and the write-off of certain operating assets, were accounted for as a charge to earnings and

included in “other operating expense, net” within the consolidated statements of operations.

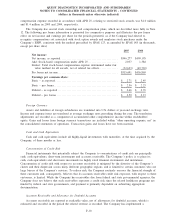

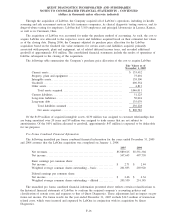

5. TAXES ON INCOME

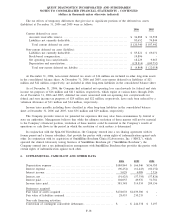

The Company’s pretax income from continuing operations consisted of $1.02 billion, $943 million and $817

million from U.S. operations and approximately $8.6 million, $7.2 million and $8.1 million from foreign

operations for the years ended December 31, 2006, 2005 and 2004, respectively.

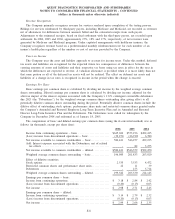

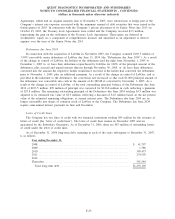

The components of income tax expense (benefit) for 2006, 2005 and 2004 were as follows:

2006 2005 2004

Current:

Federal . . ............................................................ $360,806 $304,117 $231,514

State and local....................................................... 93,292 63,652 49,939

Foreign. . ............................................................ 4,586 2,081 (807)

Deferred:

Federal . . ............................................................ (26,897) 2,614 40,827

State and local....................................................... (24,206) 4,348 10,998

Total. . ............................................................ $407,581 $376,812 $332,471

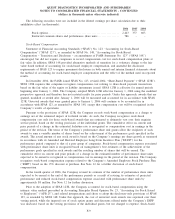

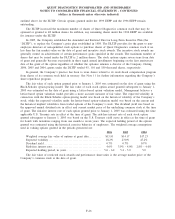

A reconciliation of the federal statutory rate to the Company’s effective tax rate for 2006, 2005 and 2004

was as follows:

2006 2005 2004

Tax provision at statutory rate. . . ....................................... 35.0% 35.0% 35.0%

State and local income taxes, net of federal benefit. ..................... 4.3 4.6 4.6

Impact of foreign operations............................................ 0.3 - 0.2

Non-deductible expenses, primarily meals and entertainment expenses . . . . 0.3 0.2 0.4

Other, net ............................................................. (0.5) (0.1) 0.1

Effective tax rate .................................................... 39.4% 39.7% 40.3%

F-17

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)