Quest Diagnostics 2006 Annual Report Download - page 84

Download and view the complete annual report

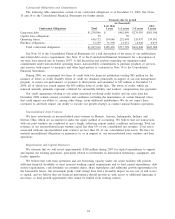

Please find page 84 of the 2006 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cash Flows from Investing Activities

Net cash used in investing activities in 2006 was $414 million, consisting primarily of $231 million related

to the acquisition of Focus Diagnostics and Enterix, (a privately held test kit manufacturer), and capital

expenditures of $193 million. These amounts were partially offset by $16 million of proceeds from the sale of an

investment. The decrease in capital expenditures compared to the prior year is principally due to the completion

of a new facility in California, for which there were substantial expenditures in the prior year.

Net cash used in investing activities in 2005 was $1.1 billion, consisting primarily of the acquisition of

LabOne and related transaction costs for $795 million, the acquisition of a small regional laboratory for $19

million, equity investments of $38 million in companies, which develop diagnostic tests, and capital expenditures

of $224 million.

Cash Flows from Financing Activities

Net cash used in financing activities in 2006 was $480 million. During 2006, we repaid $275 million

outstanding under our 6

3

⁄

4

% senior notes, $60 million of principal outstanding under our secured receivables

credit facility and $75 million under our senior unsecured revolving credit facility. Debt repayments and

acquisitions were funded with cash on hand and borrowings of $75 million under our senior unsecured revolving

credit facility and $300 million under our secured receivables credit facility. In addition, we purchased $472

million of treasury stock, which represents 8.9 million shares of our common stock purchased at an average price

of $53.23 per share, partially offset by $102 million in proceeds from the exercise of stock options, including

related tax benefits. We also paid dividends of $77 million. At December 31, 2006, we had $300 million

outstanding, and $500 million of available borrowing capacity under our combined credit facilities. Our credit

facilities and the 2005 Senior Notes, along with our other debt outstanding are more fully described in Note 10

to the Consolidated Financial Statements.

Net cash provided by financing activities in 2005 was $247 million, consisting primarily of proceeds from

borrowings of $1.1 billion and $98 million in proceeds from the exercise of stock options, reduced by repayments

of debt totaling $497 million, purchases of treasury stock totaling $390 million and dividend payments of $70

million. Proceeds from borrowings consisted primarily of $892 million net proceeds from the private placement

of $900 million of senior notes, or the 2005 Senior Notes, used to finance the acquisition of LabOne and $200

million of borrowings under our secured receivable credit facility to fund the repayment of $100 million of

principal outstanding under our senior unsecured revolving credit facility and seasonal cash flow requirements.

During 2005, we repaid $270 million of borrowings associated with our secured receivables credit facility and

$100 million of principal outstanding under our senior unsecured revolving credit facility. In addition, we repaid

approximately $127 million of principal, representing substantially all of LabOne’s outstanding debt that was

assumed by us in connection with the LabOne acquisition. The $390 million in treasury stock purchases

represents 7.8 million shares of our common stock purchased at an average price of $49.98 per share.

Dividend Program

During each of the quarters of 2006 and 2005, our Board of Directors has declared a quarterly cash dividend

of $0.10 and $0.09 per common share, respectively. We expect to fund future dividend payments with cash flows

from operations, and do not expect the dividend to have a material impact on our ability to finance future

growth.

Share Repurchase Plan

In January 2006, our Board of Directors expanded the share repurchase authorization by an additional $600

million, bringing the total amount authorized and available for purchases to $722 million. For the year ended

December 31, 2006, we repurchased approximately 8.9 million shares of our common stock at an average price

of $53.23 per share for $472 million. Through December 31, 2006, we have repurchased approximately 41.3

million shares of our common stock at an average price of $44.89 for $1.9 billion under our share repurchase

program. At December 31, 2006, the total available for repurchases under the remaining authorizations was $250

million.

63