Quest Diagnostics 2006 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2006 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Through the acquisition of LabOne, the Company acquired all of LabOne’s operations, including its health

screening and risk assessment services for life insurance companies, its clinical diagnostic testing services, and its

drugs-of-abuse testing for employers. LabOne had 3,100 employees and principal laboratories in Lenexa, Kansas,

as well as in Cincinnati, Ohio.

The acquisition of LabOne was accounted for under the purchase method of accounting. As such, the cost to

acquire LabOne was allocated to the respective assets and liabilities acquired based on their estimated fair values

as of the closing date. During 2006, the Company adjusted its purchase price allocation for the LabOne

acquisition based on the finalized fair value estimates for certain assets and liabilities acquired, primarily

associated with property, plant and equipment, net of related deferred income taxes, and recorded additional

goodwill of approximately $10 million. The consolidated financial statements include the results of operations of

LabOne subsequent to the closing of the acquisition.

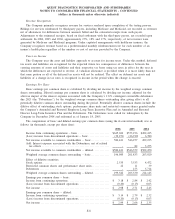

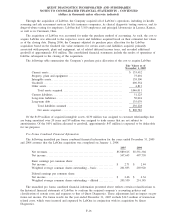

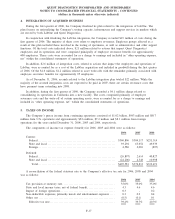

The following table summarizes the Company’s purchase price allocation of the cost to acquire LabOne:

Fair Values as of

November 1, 2005

Current assets ........................................................... $ 135,452

Property, plant and equipment ........................................... 75,692

Intangible assets. . ....................................................... 139,500

Goodwill ............................................................... 690,554

Other assets............................................................. 4,813

Total assets acquired. . .............................................. 1,046,011

Current liabilities. ....................................................... 51,125

Long-term liabilities ..................................................... 50,024

Long-term debt . . ....................................................... 135,079

Total liabilities assumed ............................................ 236,228

Net assets acquired . . . .............................................. $ 809,783

Of the $139 million of acquired intangible assets, $130 million was assigned to customer relationships that

are being amortized over 20 years and $9 million was assigned to trade names that are not subject to

amoritization. Of the $691 million allocated to goodwill, approximately $47 million is expected to be deductible

for tax purposes.

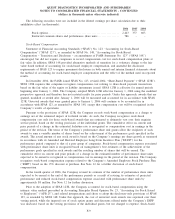

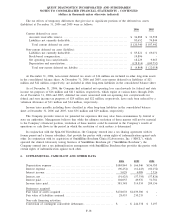

Pro Forma Combined Financial Information

The following unaudited pro forma combined financial information for the years ended December 31, 2005

and 2004 assumes that the LabOne acquisition was completed on January 1, 2004.

2005 2004

Net revenues ..................................................... $5,889,615 $5,551,304

Net income ...................................................... 547,643 497,758

Basic earnings per common share:

Net income ...................................................... $ 2.71 $ 2.44

Weighted average common shares outstanding – basic.............. 201,833 203,920

Diluted earnings per common share:

Net income ...................................................... $ 2.66 $ 2.34

Weighted average common shares outstanding – diluted . . . ......... 205,530 214,145

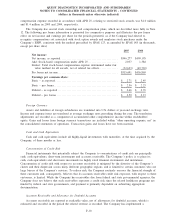

The unaudited pro forma combined financial information presented above reflects certain reclassifications to

the historical financial statements of LabOne to conform the acquired company’s accounting policies and

classification of certain costs and expenses to that of Quest Diagnostics. These adjustments had no impact on pro

forma net income. Pro forma results for the year ended December 31, 2005 exclude $14.3 million of transaction

related costs, which were incurred and expensed by LabOne in conjunction with its acquisition by Quest

Diagnostics.

F-16

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)