Quest Diagnostics 2006 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2006 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.associated with the acceleration of certain pension obligations in connection with the succession of the

Company’s prior CEO.

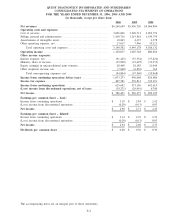

Operating Income

Operating income for the year ended December 31, 2005 improved to $1.0 billion, or 18.5% of net

revenues, from $881 million, or 17.4% of net revenues, in the prior year period. The increases in operating

income for the year ended December 31, 2005 were principally driven by revenue growth and continued benefits

from our Six Sigma and standardization initiatives. Operating income as a percentage of revenues compared to

the prior year was reduced by approximately 0.2% due to LabOne’s lower margins.

Other Income (Expense)

Interest expense, net for the year ended December 31, 2005 approximated the prior year level. The

redemption of our contingent convertible debentures in January 2005 and increased interest income principally

served to reduce net interest expense in 2005, which was offset by the interest expense related to the financing of

the LabOne acquisition. Interest expense, net for the year ended December 31, 2004 included a $2.9 million

charge representing the write-off of deferred financing costs associated with the second quarter 2004 refinancing

of our bank debt and credit facility.

Other (expense) income, net represents miscellaneous income and expense items related to non-operating

activities such as gains and losses associated with investments and other non-operating assets. For the year ended

December 31, 2005, other (expense) income, net included a $7.1 million charge associated with the write-down

of an investment.

Discontinued Operations

Our discontinued operations are comprised of NID a test kit manufacturing subsidiary. During the fourth

quarter of 2005, NID instituted its second voluntary product hold within a six-month period, due to quality

issues, which adversely impacted its operating performance. Prior to these product holds NID accounted for about

1% of consolidated net revenues. Earnings before taxes for NID decreased by approximately $50 million or $0.16

per diluted share as compared to 2004. The second product hold caused us to reevaluate the financial outlook for

NID, and as a result of this analysis we recorded certain pretax charges as described below. These charges,

coupled with the operating losses at NID stemming from the product holds, together with the costs to rectify

NID’s quality issues and comply with an ongoing government investigation and regulatory review of NID, caused

us to further evaluate a number of strategic options for NID. On April 19, 2006, we decided to discontinue

NID’s operations. During the third quarter of 2006, we completed the wind-down of NID’s operations. Results of

NID are reported as discontinued operations for all periods presented.

Loss from discontinued operations, net of tax, for the year ended December 31, 2005 was $27 million, or

$0.13 per diluted share, compared to a gain of $7 million, or $0.03 per diluted share in 2004. Results for the

year ended December 31, 2005 reflect pre-tax charges of $16 million recorded during the fourth quarter of 2005.

These charges included the write-off of all of the goodwill associated with NID of $7.5 million, and other write-

offs totaling $8.5 million, principally related to products and equipment inventory. In addition, during the second

quarter of 2005, in connection with its first product hold, NID recorded a charge of approximately $3 million,

principally related to products and equipment inventory.

The government continues to investigate and review NID. Any costs resulting from this review will be

included in discontinued operations. While we do not believe that these matters will have a material adverse

impact on our overall financial condition, their final resolution could be material to our results of operations or

cash flows in the period in which the impact of such matters is determined or paid. See Note 14 to the

Consolidated Financial Statements for a further description of these matters.

Quantitative and Qualitative Disclosures About Market Risk

We address our exposure to market risks, principally the market risk of changes in interest rates, through a

controlled program of risk management that may include the use of derivative financial instruments. We do not

hold or issue derivative financial instruments for speculative purposes. We do not believe that our foreign

exchange exposure is material to our consolidated financial condition or results of operations. See Note 2 to the

Consolidated Financial Statements for additional discussion of our financial instruments and hedging activities.

See Note 10 to the Consolidated Financial Statements for information regarding our treasury lock agreements.

61