Quest Diagnostics 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.uncertainty in income taxes recognized in financial statements in accordance with SFAS No. 109 “Accounting for

Income Taxes”. FIN 48 provides guidance on recognizing, measuring, presenting and disclosing in the financial

statements uncertain tax positions that a company has taken or expects to take on a tax return. The Company has

identified and categorized its uncertain tax positions and these positions have been evaluated and assessed for

recognition and measurement under the guidelines of FIN 48. The adoption of FIN 48 will not impact the

consolidated statement of operations, however, FIN 48 may create some volatility in the effective tax rate in

future periods. While the Company’s analysis is still underway and not yet completed, at this point it is not

anticipated that the adoption of FIN 48 will have a material impact on the consolidated balance sheet. The

transition adjustments for FIN 48 primarily relate to uncertainties associated with the realization of tax benefits

derived from certain state net operating loss carryforwards, the allocation of income and expense among state

jurisdictions, the characterization and timing of certain tax deductions associated with business combinations and

employee compensation, and income and expenses associated with certain intercompany licensing arrangements.

In September 2006, the FASB issued SFAS No. 157 “Fair Value Measurements” (“SFAS 157”). SFAS 157

provides a new single authoritative definition of fair value and provides enhanced guidance for measuring the fair

value of assets and liabilities and requires additional disclosures related to the extent to which companies measure

assets and liabilities at fair value, the information used to measure fair value, and the effect of fair value

measurements on earnings. SFAS 157 is effective for the Company as of January 1, 2008. The Company is

currently assessing the impact, if any, of SFAS 157 on its consolidated financial statements.

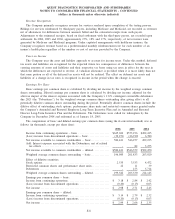

In September 2006, the FASB issued SFAS No. 158 “Employers’ Accounting for Defined Benefit Pension

and Other Postretirement Plans – an amendment of FASB Statements No. 87, 88, 106, and 132(R)” (“SFAS

158”). SFAS 158 requires balance sheet recognition of the overfunded or underfunded status of pension and

postretirement benefit plans. Under SFAS 158, actuarial gains and losses, prior service costs or credits, and any

remaining transition assets or obligations that have not been recognized under previous accounting standards must

be recognized as a component of accumulated other comprehensive income (loss) within stockholders’ equity, net

of tax effects, until they are amortized as a component of net periodic benefit cost. In addition, the measurement

date and the date at which plan assets and the benefit obligation are measured, are required to be the company’s

fiscal year end. SFAS 158 is effective for the Company as of December 31, 2006, except for the measurement

date provisions, which are effective December 31, 2008. The adoption of SFAS 158 did not have a material

impact on the Company’s consolidated financial statements.

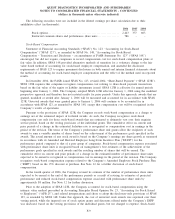

In September 2006, the SEC released Staff Accounting Bulletin No. 108 “Considering the Effects of Prior

Year Misstatements When Quantifying Misstatements in Current Year Financial Statements” (“SAB 108”). SAB

108 provides interpretative guidance on how public companies quantify financial statement misstatements. There

have been two common approaches used to quantify such errors. Under an income statement approach, the “roll-

over” method, the error is quantified as the amount by which the current year income statement is misstated.

Alternatively, under a balance sheet approach, the “iron curtain” method, the error is quantified as the cumulative

amount by which the current year balance sheet is misstated. In SAB 108, the SEC established an approach that

requires quantification of financial statement misstatements based on the effects of the misstatements on each of

the company’s financial statements and the related financial statement disclosures. This model is commonly

referred to as a “dual approach” because it requires quantification of errors under both the roll-over and iron

curtain methods. SAB 108 is effective for the Company as of December 31, 2006. The adoption of SAB 108 did

not have an impact on the Company’s consolidated financial statements.

In February 2007, the FASB issued SFAS No. 159 “The Fair Value Option for Financial Assets and

Financial Liabilities” (“SFAS 159”). SFAS 159 provides companies with an option to irrevocably elect to

measure certain financial assets and financial liabilities at fair value on an instrument-by-instrument basis with the

resulting changes in fair value recorded in earnings. The objective of SFAS 159 is to reduce both the complexity

in accounting for financial instruments and the volatility in earnings caused by using different measurement

attributes for financial assets and liabilities. The Company is currently evaluating the impact of SFAS 159 to

determine the effect, if any, it will have on the consolidated financial position and results of operations. The

Company is required to adopt SFAS 159 as of January 1, 2008.

F-14

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)