Quest Diagnostics 2006 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2006 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

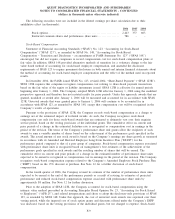

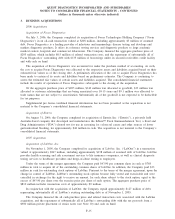

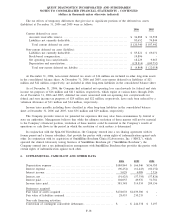

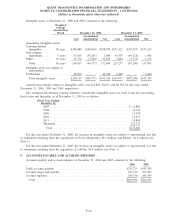

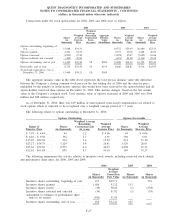

7. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment at December 31, 2006 and 2005 consisted of the following:

2006 2005

Land ..................................................................... $ 36,272 $ 36,255

Buildings and improvements . . ............................................ 332,610 329,441

Laboratory equipment, furniture and fixtures ............................... 886,065 823,799

Leasehold improvements .................................................. 264,096 190,329

Computer software developed or obtained for internal use . ................. 189,083 171,724

Construction-in-progress................................................... 58,273 98,897

1,766,399 1,650,445

Less: accumulated depreciation and amortization . .......................... (1,014,042) (896,782)

Total .................................................................. $ 752,357 $ 753,663

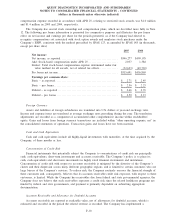

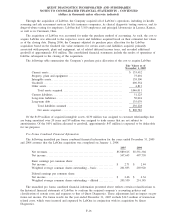

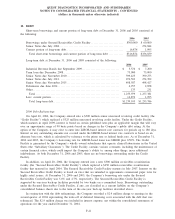

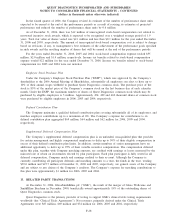

8. GOODWILL AND INTANGIBLE ASSETS

Goodwill at December 31, 2006 and 2005 consisted of the following:

2006 2005

Goodwill.................................................................. $3,572,238 $3,385,280

Less: accumulated amortization ............................................ (181,192) (188,053)

Goodwill, net . . . .......................................................... $3,391,046 $3,197,227

The changes in the gross carrying amount of goodwill for the years ended December 31, 2006 and 2005 are

as follows:

2006 2005

Balance as of January 1 . . ................................................. $3,385,280 $2,695,003

Goodwill acquired during the year . ........................................ 196,222 697,766

Other . . ................................................................... (9,264) (7,489)

Balance as of December 31 ................................................ $3,572,238 $3,385,280

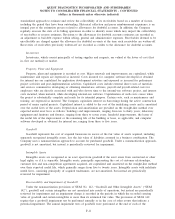

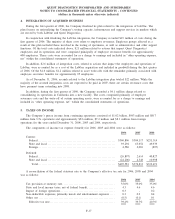

For the year ended December 31, 2006, the increase in goodwill was primarily related to the acquisitions of

Focus Diagnostics and Enterix, and adjustments associated with the LabOne purchase price allocation and the

LabOne integration plan. These additions were $142 million, $40 million and $10 million, respectively. In

connection with the Company’s decision to discontinue the operations of NID in the second quarter of 2006, the

Company eliminated the goodwill and related accumulated amortization associated with NID, which had no

impact on goodwill, net. In addition, goodwill was reduced $2.4 million primarily related to the favorable

resolution of certain pre-acquisition tax contingencies associated with businesses acquired.

For the year ended December 31, 2005, the increase in goodwill was primarily related to the acquisition of

LabOne. During the fourth quarter of 2005, the Company recorded a $7.5 million charge, which was included in

“other operating expense, net” in the consolidated statement of operations, to write off all of the goodwill

associated with NID.

F-19

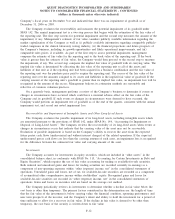

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)