Quest Diagnostics 2006 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2006 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

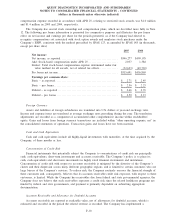

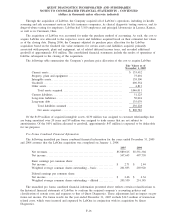

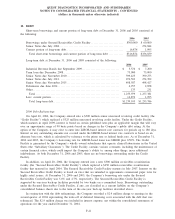

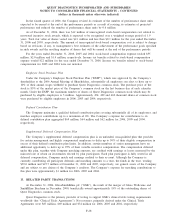

Intangible assets at December 31, 2006 and 2005 consisted of the following:

Cost

Accumulated

Amortization Net Cost

Accumulated

Amortization Net

Weighted

Average

Amortization

Period December 31, 2006 December 31, 2005

Amortizing intangible assets:

Customer-related

intangibles ....... 18 years $206,880 $(48,010) $158,870 $172,522 $(39,297) $133,225

Non-compete

agreements....... 5 years 47,165 (45,261) 1,904 45,707 (44,221) 1,486

Other .............. 10 years 15,372 (3,500) 11,872 7,044 (3,772) 3,272

Total . . .......... 18 years 269,417 (96,771) 172,646 225,273 (87,290) 137,983

Intangible assets not subject to

amortization:

Tradenames ....................... 20,700 - 20,700 9,400 - 9,400

Total intangible assets . . . ........ $290,117 $(96,771) $193,346 $234,673 $(87,290) $147,383

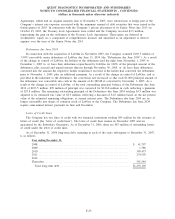

Amortization expense related to intangible assets was $10,843, $4,637 and $6,378 for the years ended

December 31, 2006, 2005 and 2004, respectively.

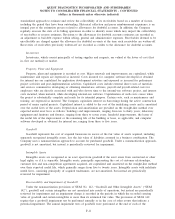

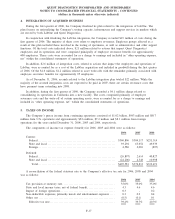

The estimated amortization expense related to amortizable intangible assets for each of the five succeeding

fiscal years and thereafter as of December 31, 2006 is as follows:

Fiscal Year Ending

December 31,

2007.............................................................. $ 11,882

2008.............................................................. 11,743

2009.............................................................. 11,329

2010.............................................................. 11,071

2011.............................................................. 10,849

Thereafter. . . ...................................................... 115,772

Total ........................................................... $172,646

For the year ended December 31, 2006, the increase in intangible assets not subject to amortization was due

to tradenames resulting from the acquisitions of Focus Diagnostics, $9.1 million, and Enterix, $2.2 million (see

Note 3).

For the year ended December 31, 2005, the increase in intangible assets not subject to amortization was due

to tradenames resulting from the acquisition of LabOne, $9.4 million (see Note 3).

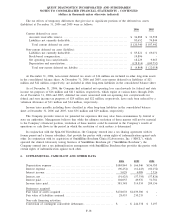

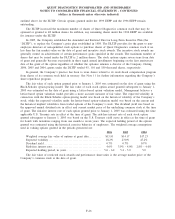

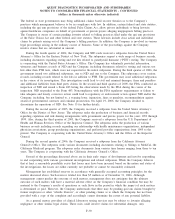

9. ACCOUNTS PAYABLE AND ACCRUED EXPENSES

Accounts payable and accrued expenses at December 31, 2006 and 2005 consisted of the following:

2006 2005

Trade accounts payable ....................................................... $215,721 $193,385

Accrued wages and benefits ................................................... 321,539 275,709

Accrued expenses ............................................................. 296,736 295,359

Total....................................................................... $833,996 $764,453

F-20

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)