Quest Diagnostics 2006 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2006 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

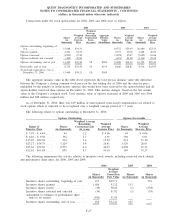

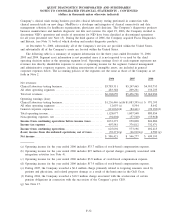

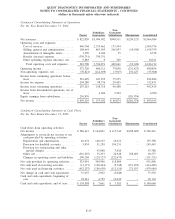

2006 2005 2004

Depreciation and amortization:

Clinical laboratory testing business .......................................... $167,672 $156,920 $148,804

All other operating segments ................................................ 16,375 8,441 6,919

General corporate........................................................... 11,640 5,822 7,610

Discontinued operations . . ................................................... 1,711 4,941 5,393

Total depreciation and amortization .......................................... $197,398 $176,124 $168,726

Capital expenditures:

Clinical laboratory testing business .......................................... $168,636 $204,469 $167,203

All other operating segments ................................................ 17,291 13,445 3,657

General corporate........................................................... 6,722 3,912 2,379

Discontinued operations . . ................................................... 773 2,444 2,886

Total capital expenditures ................................................... $193,422 $224,270 $176,125

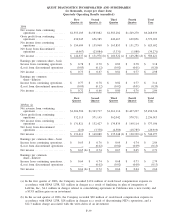

17. SUBSEQUENT EVENT

Acquisition of HemoCue

On January 31, 2007, the Company acquired POCT Holding AB (“HemoCue”), a Sweden-based company

specializing in point-of-care testing, also referred to as near patient testing, in an all-cash transaction valued at

approximately $420 million, including $123 million of assumed debt of HemoCue. The transaction, which has

been financed through a new credit facility, is not expected to have a material impact on the Company’s 2007

financial results.

HemoCue is the leading international provider in near patient testing for hemoglobin, with a growing share

in professional glucose and microalbumin testing. In addition, HemoCue is currently developing new tests

including a near patient test to determine white blood cell counts.

New Credit Facility

On January 31, 2007, the Company entered into an Interim Credit Agreement (“Interim Credit Facility”) for

a $450 million senior unsecured loan and borrowed $450 million to acquire HemoCue, and to pay fees, costs and

expenses incurred in connection with the acquisition.

Under the Interim Credit Facility, which matures on January 31, 2008, interest is based on certain published

rates plus an applicable margin that will vary over an approximate range of 45 basis points based on changes in

the Company’s public debt rating. At its option, the Company may elect to enter into LIBOR-based interest rate

contracts for periods up to six months. Interest on any outstanding amounts not covered under the LIBOR-based

interest rate contracts is based on an alternate base rate, which is calculated by reference to the prime rate or

federal funds rate. The Interim Credit Facility is guaranteed by the Company’s domestic wholly owned operating

subsidiaries. The Interim Credit Facility contains various covenants similar to those under the Credit Facility. In

addition, the Interim Credit Facility provides for the mandatory pre-payment of the loan in the event of a debt or

equity issuance by the Company, subject to certain limited exceptions as set forth in the Interim Credit

Agreement.

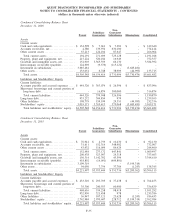

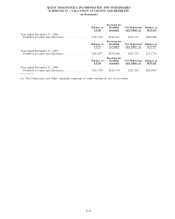

18. SUMMARIZED FINANCIAL INFORMATION

As described in Note 10, the 2005 Senior Notes, the 2001 Senior Notes and the Debentures are fully and

unconditionally guaranteed by the Subsidiary Guarantors. With the exception of Quest Diagnostics Receivables

Incorporated (see paragraph below), the non-guarantor subsidiaries are primarily foreign and less than wholly

owned subsidiaries. In January 2005, the Company completed its redemption of all of its outstanding Debentures.

In July 2006, the Company repaid at maturity the $275 million outstanding under its Senior Notes due 2006.

In conjunction with the Company’s Secured Receivables Credit Facility described in Note 10, the Company

maintains a wholly owned non-guarantor subsidiary, Quest Diagnostics Receivables Incorporated (“QDRI”). The

F-33

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)