Quest Diagnostics 2006 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2006 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

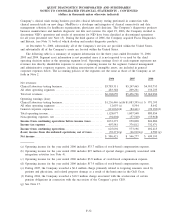

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)

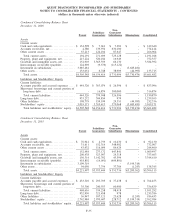

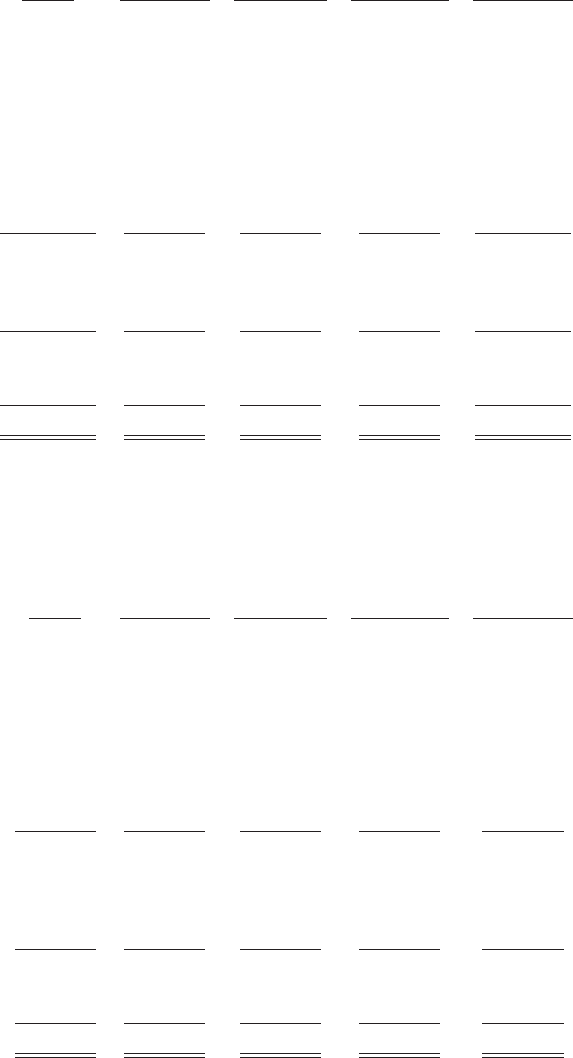

Condensed Consolidating Statement of Cash Flows

For the Year Ended December 31, 2005

Parent

Subsidiary

Guarantors

Non-

Guarantor

Subsidiaries Eliminations Consolidated

Cash flows from operating activities:

Net income .............................. $ 546,277 $ 168,221 $ 58,606 $(226,827) $ 546,277

Adjustments to reconcile net income to

net cash provided by operating

activities:

Depreciation and amortization .......... 51,943 113,506 10,675 - 176,124

Provision for doubtful accounts ......... 5,659 43,669 184,300 - 233,628

Other, net ............................. (203,458) 33,809 20,511 226,827 77,689

Changes in operating assets and

liabilities ............................ 174,884 (214,707) (142,312) - (182,135)

Net cash provided by operating activities . . 575,305 144,498 131,780 - 851,583

Net cash used in investing activities....... (1,020,236) (176,202) (15,243) 131,888 (1,079,793)

Net cash provided by (used in) financing

activities .............................. 465,448 30,405 (116,927) (131,888) 247,038

Net change in cash and cash equivalents . . 20,517 (1,299) (390) - 18,828

Cash and cash equivalents, beginning of

year ................................... 56,424 6,058 10,820 - 73,302

Cash and cash equivalents, end of year. . . . $ 76,941 $ 4,759 $ 10,430 $ - $ 92,130

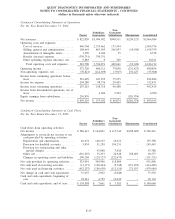

Condensed Consolidating Statement of Cash Flows

For the Year Ended December 31, 2004

Parent

Subsidiary

Guarantors

Non-

Guarantor

Subsidiaries Eliminations Consolidated

Cash flows from operating activities:

Net income . . . ............................. $ 499,195 $ 153,102 $ 48,874 $(201,976) $ 499,195

Adjustments to reconcile net income to net

cash provided by (used in) operating

activities:

Depreciation and amortization . ........... 56,399 101,856 10,471 - 168,726

Provision for doubtful accounts........... 4,940 43,638 177,732 - 226,310

Other, net . . ............................. (71,374) 1,754 16,847 201,976 149,203

Changes in operating assets and liabilities. 163,057 (118,129) (289,582) - (244,654)

Net cash provided by (used in) operating

activities . . . ............................. 652,217 182,221 (35,658) - 798,780

Net cash used in investing activities ........ (150,826) (105,597) (7,841) 90,564 (173,700)

Net cash provided by (used in) financing

activities . . . ............................. (586,555) (72,557) 42,940 (90,564) (706,736)

Net change in cash and cash equivalents . . . . (85,164) 4,067 (559) - (81,656)

Cash and cash equivalents, beginning of

year .................................... 141,588 1,991 11,379 - 154,958

Cash and cash equivalents, end of year . . . . . $ 56,424 $ 6,058 $ 10,820 $ - $ 73,302

F-38