Quest Diagnostics 2006 Annual Report Download - page 102

Download and view the complete annual report

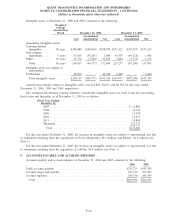

Please find page 102 of the 2006 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.3. BUSINESS ACQUISITIONS

2006 Acquisitions

Acquisition of Focus Diagnostics

On July 3, 2006, the Company completed its acquisition of Focus Technologies Holding Company (“Focus

Diagnostics”) in an all-cash transaction valued at $208 million, including approximately $3 million of assumed

debt. Focus Diagnostics is a leading provider of infectious and immunologic disease testing and develops and

markets diagnostic products. It offers its reference testing services and diagnostic products to large academic

medical centers, hospitals and commercial laboratories. The Company financed the aggregate purchase price of

$205 million, which includes $0.5 million of related transaction costs, and the repayment of substantially all of

Focus Diagnostics’ outstanding debt with $135 million of borrowings under its secured receivables credit facility

and with cash on hand.

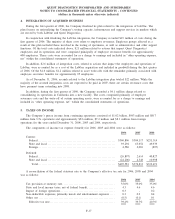

The acquisition of Focus Diagnostics was accounted for under the purchase method of accounting. As such,

the cost to acquire Focus Diagnostics was allocated to the respective assets and liabilities acquired based on their

estimated fair values as of the closing date. A preliminary allocation of the cost to acquire Focus Diagnostics has

been made to certain of its assets and liabilities based on preliminary estimates. The Company is continuing to

assess the estimated fair values of certain assets and liabilities acquired. The consolidated financial statements

include the results of operations of Focus Diagnostics subsequent to the closing of the acquisition.

Of the aggregate purchase price of $205 million, $142 million was allocated to goodwill, $33 million was

allocated to customer relationships that are being amortized over 10-15 years and $9.1 million was allocated to

trade names that are not subject to amortization. Substantially all of the goodwill is not expected to be deductible

for tax purposes.

Supplemental pro forma combined financial information has not been presented as the acquisition is not

material to the Company’s consolidated financial statements.

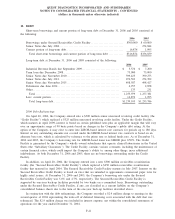

Acquisition of Enterix

On August 31, 2006, the Company completed its acquisition of Enterix Inc. (“Enterix”), a privately held

Australia-based company that developed and manufactures the InSureTM Fecal Immunochemical Test, a Food and

Drug Administration (“FDA”)-cleared test for use in screening for colorectal cancer and other sources of lower

gastrointestinal bleeding, for approximately $44 million in cash. The acquisition is not material to the Company’s

consolidated financial statements.

2005 Acquisition

Acquisition of LabOne, Inc.

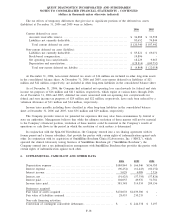

On November 1, 2005, the Company completed its acquisition of LabOne, Inc. (“LabOne”) in a transaction

valued at approximately $947 million, including approximately $138 million of assumed debt of LabOne. LabOne

provides health screening and risk assessment services to life insurance companies, as well as clinical diagnostic

testing services to healthcare providers and drugs-of-abuse testing to employers.

Under the terms of the merger agreement, the Company paid $43.90 per common share in cash or $768

million in total to acquire all of the outstanding common shares of LabOne. In addition, the Company paid $33

million in cash for outstanding stock options of LabOne. Pursuant to the terms of the merger agreement, upon the

change in control of LabOne, LabOne’s outstanding stock options became fully vested and exercisable and were

cancelled in exchange for the right to receive an amount, for each share subject to the stock option, equal to the

excess of $43.90 per share over the exercise price per share of each option. The aggregate purchase price of

$810 million includes transaction costs of approximately $9 million.

In conjunction with the acquisition of LabOne, the Company repaid approximately $127 million of debt,

representing substantially all of LabOne’s existing outstanding debt as of November 1, 2005.

The Company financed the all cash purchase price and related transaction costs associated with the LabOne

acquisition, and the repayment of substantially all of LabOne’s outstanding debt with the net proceeds from a

$900 million private placement of senior notes (see Note 10) and cash on hand.

F-15

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)