Quest Diagnostics 2006 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2006 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Integrating our operations with business we acquire may be difficult and, if unsuccessfully executed, may

have a material adverse effect on our business.

We are in the process of integrating into our Company the operations of several companies that we have

acquired during the past eighteen months, including LabOne and Focus Diagnostics. See “Business – Recent

Acquisitions”. We expect to continue to selectively evaluate potential acquisitions of domestic clinical laboratories

that can be integrated into our existing laboratories. We are actively exploring opportunities in the area of near

patient testing and intend to capitalize on this trend to augment our laboratory testing business. Additionally, we

see opportunities to bring our experience and expertise in diagnostic testing to international markets, particularly

developing countries where the testing markets are highly fragmented and less mature. Each acquisition involves

the integration of a separate company that previously operated independently and has different systems, processes

and cultures. The process of combining such companies may be disruptive to both of our businesses and may

cause an interruption of, or a loss of momentum in, such businesses as a result of the following difficulties,

among others:

•loss of key customers or employees;

•failure to maintain the quality of services that our Company has historically provided;

•diversion of management’s attention from the day-to-day business of our Company as a result of the need

to deal with the foregoing disruptions and difficulties; and

•the added costs of dealing with such disruptions.

In addition, because most of our clinical laboratory testing is performed under arrangements that are

terminable at will or on short notice, any such interruption of or deterioration in our services may result in a

customer’s decision to stop using us for clinical laboratory testing.

Even if we are able to successfully complete the integration of Focus Diagnostics or the operations of other

companies or business we may acquire in the future, we may not be able to realize all or any of the benefits that

we expect to result from such integration, either in monetary terms or a timely manner.

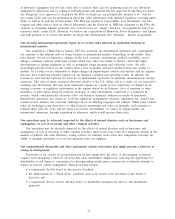

Our outstanding debt may impair our financial and operating flexibility.

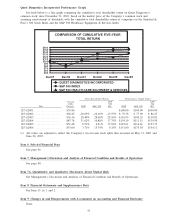

As of December 31, 2006, we had approximately $1.56 billion of debt outstanding, with $500 million of

available capacity under our senior unsecured revolving credit facility. Except for outstanding letters of credit and

operating leases, we do not have any off-balance sheet financing arrangements in place or available. See Note 10

to the Consolidated Financial Statements for further details related to our outstanding debt. Set forth in the table

below, for each of the next five years, is the aggregate amount of scheduled principal, estimated interest and total

payments with respect to our debt outstanding as of December 31, 2006, including capital leases, assuming that

maturing debt is refinanced for purposes of estimating interest.

Twelve Months

Ended December 31, Principal Interest Total

(in thousands)

2007 ........................................................................ $316,870 $91,953 $408,823

2008 ........................................................................ 61,827 89,427 151,254

2009 ........................................................................ 1,826 86,898 88,724

2010 ........................................................................ 400,010 87,185 487,195

2011 ........................................................................ 275,000 77,569 352,569

On January 31, 2007, in connection with the acquisition of HemoCue, we borrowed $450 million under a

one-year term loan. See Note 17 to the Consolidated Financial Statements.

Our debt portfolio is sensitive to changes in interest rates. As of December 31, 2006, we had $375 million

of floating rate debt. Based on our net exposure to interest rate changes, an assumed 10% change in interest rates

on our variable rate indebtedness (representing approximately 54 basis points) would impact annual net interest

expense by approximately $2 million, assuming no changes to the debt outstanding at December 31, 2006. In

addition, any future borrowings by us under the unsecured revolving credit facility, the secured receivables credit

facility or the issuance of other floating rate debt will expose us to additional interest rate risk. Interest rates on

our unsecured revolving credit facility, term loan and secured receivables credit facility are also subject to a

pricing schedule that fluctuates based on changes in our credit rating.

Our debt agreements contain various restrictive covenants. These restrictions could limit our ability to use

operating cash flow in other areas of our business because we must use a portion of these funds to make

principal and interest payments on our debt.

28