Quest Diagnostics 2006 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2006 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

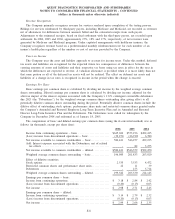

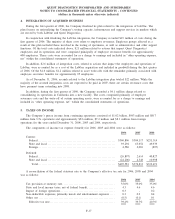

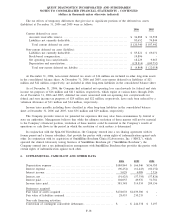

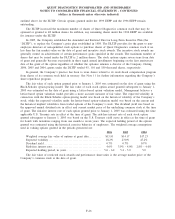

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets

(liabilities) at December 31, 2006 and 2005 were as follows:

2006 2005

Current deferred tax asset:

Accounts receivable reserve .................................................... $ 36,888 $ 32,598

Liabilities not currently deductible.............................................. 83,652 74,844

Total current deferred tax asset .............................................. $ 120,540 $ 107,442

Non-current deferred tax asset (liability):

Liabilities not currently deductible.............................................. $ 85,821 $ 69,071

Stock-based compensation...................................................... 19,896 -

Net operating loss carryforwards ............................................... 18,229 9,663

Depreciation and amortization . . ................................................ (128,814) (100,752)

Total non-current deferred tax liability. ....................................... $ (4,868) $ (22,018)

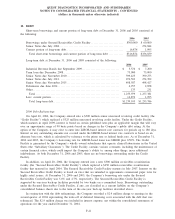

At December 31, 2006, non-current deferred tax assets of $16 million are included in other long-term assets

in the consolidated balance sheet. At December 31, 2006 and 2005, non-current deferred tax liabilities of $21

million and $22 million, respectively, are included in other long-term liabilities in the consolidated balance sheet.

As of December 31, 2006, the Company had estimated net operating loss carryforwards for federal and state

income tax purposes of $16 million and $411 million, respectively, which expire at various dates through 2026.

As of December 31, 2006 and 2005, deferred tax assets associated with net operating loss carryforwards for

federal and state income tax purposes of $29 million and $22 million, respectively, have each been reduced by a

valuation allowance of $11 million and $14 million, respectively.

Income taxes payable including those classified in other long-term liabilities in the consolidated balance

sheet at December 31, 2006 and 2005, were $36 million and $29 million, respectively.

The Company provides reserves for potential tax exposures that may arise from examinations by federal or

state tax authorities. Management believes that while the ultimate resolution of these matters will not be material

to the Company’s financial position, resolution of these matters could be material to the Company’s results of

operations or cash flows in the period in which the resolution of such matters is determined.

In conjunction with the Spin-Off Distribution, the Company entered into a tax sharing agreement with its

former parent and a former subsidiary, that provide the parties with certain rights of indemnification against each

other. In conjunction with its acquisition of SmithKline Beecham Clinical Laboratories, Inc. (“SBCL”), which

operated the clinical laboratory testing business of SmithKline Beecham plc (“SmithKline Beecham”), the

Company entered into a tax indemnification arrangement with SmithKline Beecham that provides the parties with

certain rights of indemnification against each other.

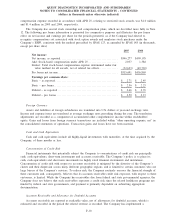

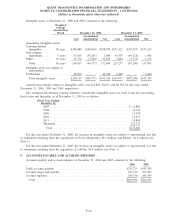

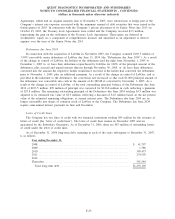

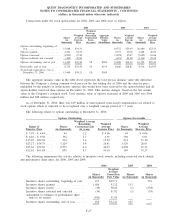

6. SUPPLEMENTAL CASH FLOW AND OTHER DATA

2006 2005 2004

Depreciation expense ................................................. $184,844 $ 166,546 $156,955

Interest expense . ..................................................... (96,454) (61,443) (60,152)

Interest income . . ..................................................... 5,029 4,089 2,326

Interest, net .......................................................... (91,425) (57,354) (57,826)

Interest paid.......................................................... 102,055 49,976 51,781

Income taxes paid .................................................... 381,348 314,534 209,156

Businesses acquired:

Fair value of assets acquired .......................................... $278,078 $1,039,300 $ -

Fair value of liabilities assumed....................................... 28,453 230,235 -

Non-cash financing activities:

Conversion of contingent convertible debentures ....................... $ - $ 244,338 $ 3,197

F-18

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)