Quest Diagnostics 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

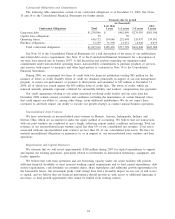

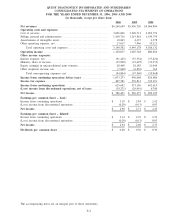

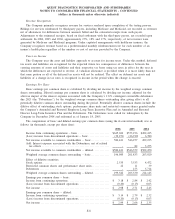

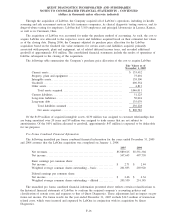

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2006, 2005 AND 2004

(in thousands)

Shares of

Common

Stock

Outstanding

Common

Stock

Additional

Paid-In

Capital

Retained

Earnings

Unearned

Compen-

sation

Accumulated

Other

Compre-

hensive

(Loss)

Income

Treasury

Stock

Compre-

hensive

Income

Balance, December 31, 2003 . . . . . . 205,627 $1,068 $2,267,014 $ 380,559 $(2,346) $ 5,947 $(257,548)

Net income . . . . . . . . . . . . . . . . . . . . . . . 499,195 $499,195

Other comprehensive loss . . . . . . . . . . (2,081) (2,081)

Comprehensive income . . . . . . . . . . . . $497,114

Dividends declared . . . . . . . . . . . . . . . . (61,020)

Issuance of common stock under

benefit plans . . . . . . . . . . . . . . . . . . . . 404 1 1,314 951 12,623

Exercise of stock options . . . . . . . . . . 6,949 (136,932) 246,048

Shares to cover employee payroll

tax withholdings on stock issued

under benefit plans . . . . . . . . . . . . . . (179) (1) (7,548)

Tax benefits associated with stock-

based compensation plans. . . . . . . . 71,276

Conversion of contingent

convertible debentures . . . . . . . . . . . 74 222 3,102

Amortization of unearned

compensation . . . . . . . . . . . . . . . . . . . 1,384

Purchases of treasury stock . . . . . . . . (16,655) (734,577)

Balance, December 31, 2004 . . . . . . 196,220 1,068 2,195,346 818,734 (11) 3,866 (730,352)

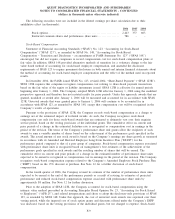

Net income . . . . . . . . . . . . . . . . . . . . . . . 546,277 $546,277

Other comprehensive loss . . . . . . . . . . (10,071) (10,071)

Comprehensive income . . . . . . . . . . . . $536,206

Adjustment for 2-for-1 stock split . . 1,068 (1,068)

Dividends declared . . . . . . . . . . . . . . . . (72,501)

Issuance of common stock under

benefit plans . . . . . . . . . . . . . . . . . . . . 516 1 4,620 (5,347) 17,683

Exercise of stock options . . . . . . . . . . 3,893 (69,691) 168,026

Shares to cover employee payroll

tax withholdings on stock issued

under benefit plans . . . . . . . . . . . . . . (7)

Tax benefits associated with stock-

based compensation plans. . . . . . . . 33,823

Conversion of contingent

convertible debentures . . . . . . . . . . . 5,632 12,510 237,136

Amortization of unearned

compensation . . . . . . . . . . . . . . . . . . . 2,037

Purchases of treasury stock . . . . . . . . (7,806) (390,163)

Balance, December 31, 2005 . . . . . . 198,455 2,137 2,175,533 1,292,510 (3,321) (6,205) (697,670)

Net income . . . . . . . . . . . . . . . . . . . . . . . 586,421 $586,421

Other comprehensive income. . . . . . . 6,140 6,140

Comprehensive income . . . . . . . . . . . . $592,561

Dividends declared . . . . . . . . . . . . . . . . (78,676)

Reclassification upon adoption of

SFAS123R. . . . . . . . . . . . . . . . . . . . . . (3,321) 3,321

Issuance of common stock under

benefit plans . . . . . . . . . . . . . . . . . . . . 598 1 (2,158) 23,838

Stock-based compensation expense . 55,478

Exercise of stock options . . . . . . . . . . 3,782 (75,603) 177,927

Shares to cover employee payroll

tax withholdings on stock issued

under benefit plans . . . . . . . . . . . . . . (13) (672)

Tax benefits associated with stock-

based compensation plans. . . . . . . . 35,816

Purchases of treasury stock . . . . . . . . (8,873) (472,325)

Balance, December 31, 2006 . . . . . . 193,949 $2,138 $2,185,073 $1,800,255 $ - $ (65) $(968,230)

The accompanying notes are an integral part of these statements.

F-6