Quest Diagnostics 2006 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2006 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

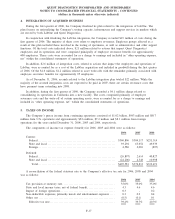

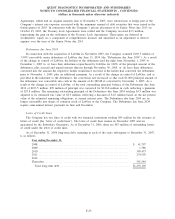

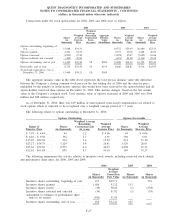

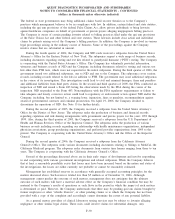

Transactions under the stock option plans for 2006, 2005 and 2004 were as follows:

Shares

(in

thousands)

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Term

(in years)

Aggregate

Intrinsic

Value

(in millions)

Shares

(in

thousands)

Weighted

Average

Exercise

Price

Shares

(in

thousands)

Weighted

Average

Exercise

Price

2006 2005 2004

Options outstanding, beginning of

year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15,048 $34.33 16,752 $29.49 20,480 $22.43

Options granted . . . . . . . . . . . . . . . . . . . . 2,501 52.57 2,777 49.66 4,428 40.85

Options exercised . . . . . . . . . . . . . . . . . . (3,835) 27.40 (3,990) 25.87 (7,042) 16.06

Options forfeited and canceled . . . . . . (465) 45.90 (491) 24.48 (1,114) 29.65

Options outstanding, end of year . . . . 13,249 $39.44 5.8 $180 15,048 $34.33 16,752 $29.49

Exercisable, end of year . . . . . . . . . . . . 8,154 $33.50 5.6 $159 8,660 $28.81 8,516 $23.95

Vested and expected to vest at

December 31, 2006 . . . . . . . . . . . . . . 13,006 $39.21 5.8 $180

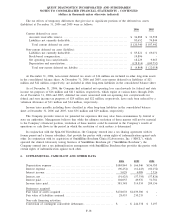

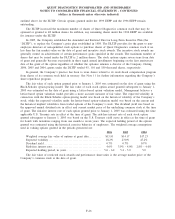

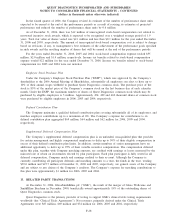

The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value (the difference

between the Company’s closing common stock price on the last trading day of 2006 and the exercise price,

multiplied by the number of in-the-money options) that would have been received by the option holders had all

option holders exercised their options on December 31, 2006. This amount changes, based on the fair market

value of the Company’s common stock. Total intrinsic value of options exercised in 2006 and 2005 was $106

million and $98 million, respectively.

As of December 31, 2006, there was $19 million of unrecognized stock-based compensation cost related to

stock options which is expected to be recognized over a weighted average period of 1.7 years.

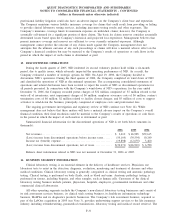

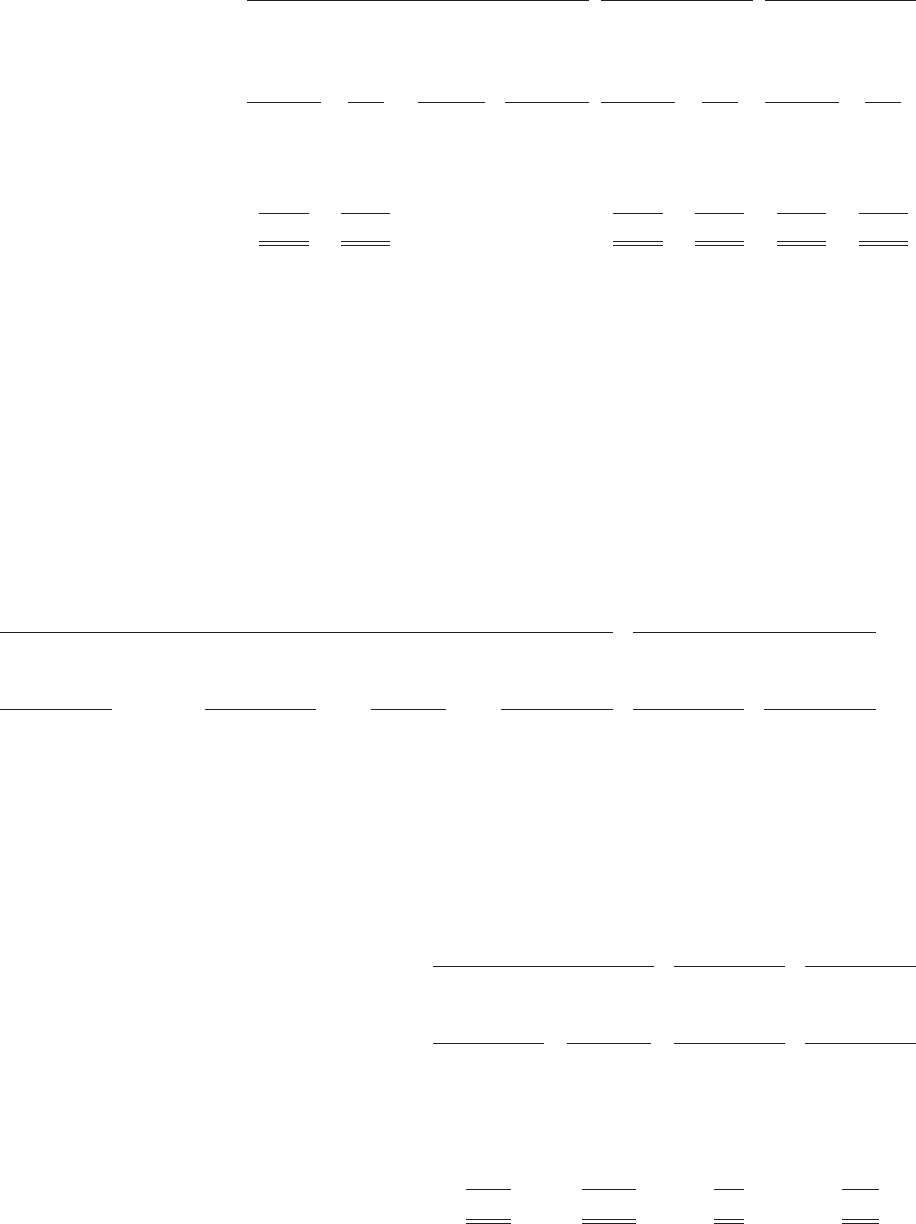

The following relates to options outstanding at December 31, 2006:

Range of

Exercise Price

Shares

(in thousands)

Weighted Average

Remaining

Contractual Life

(in years)

Weighted

Average

Exercise Price

Shares

(in thousands)

Weighted

Average

Exercise Price

Options Outstanding Options Exercisable

$ 3.97 - $ 4.44 ...... 44 1.2 $ 4.06 44 $ 4.06

$ 6.46 - $ 9.58 ...... 394 2.7 6.91 394 6.91

$15.03 - $22.38 ...... 214 3.4 15.30 214 15.30

$23.27 - $34.79 ...... 3,129 5.4 26.91 3,129 26.91

$35.01 - $52.50 ...... 8,773 6.2 44.97 4,204 41.33

$52.62 - $61.68 ...... 695 5.7 54.16 169 53.27

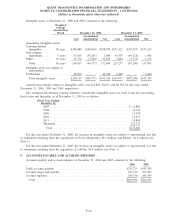

The following summarizes the activity relative to incentive stock awards, including restricted stock awards

and performance share units, for 2006, 2005 and 2004:

Shares

(in thousands)

Weighted

Average

Grant Date

Fair Value

Shares

(in thousands)

Shares

(in thousands)

2006 2005 2004

Incentive shares outstanding, beginning of year . . 107 $49.71 - 576

Incentive shares granted ........................ 1,020 52.32 113 -

Incentive shares vested . ........................ (39) 50.26 (1) (538)

Incentive shares forfeited and canceled .......... (56) 51.92 (5) (38)

Adjustment to estimate of performance share

units to be earned ............................ (582) 51.94 - -

Incentive shares outstanding, end of year . . ...... 450 $52.41 107 -

F-27

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)