Quest Diagnostics 2006 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2006 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

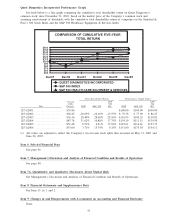

Quest Diagnostics Incorporated Performance Graph

Set forth below is a line graph comparing the cumulative total shareholder return on Quest Diagnostics’

common stock since December 31, 2001, based on the market price of the Company’s common stock and

assuming reinvestment of dividends, with the cumulative total shareholder return of companies on the Standard &

Poor’s 500 Stock Index and the S&P 500 Healthcare Equipment & Services Index.

Dec06Dec01 Dec02 Dec03 Dec04 Dec05

QUEST DIAGNOSTICS INCORPORATED

S&P 500 INDEX

S&P 500 HEALTH CARE EQUIPMENT & SERVICES

COMPARISON OF CUMULATIVE FIVE-YEAR

TOTAL RETURN

$50

$60

$70

$80

$90

$100

$110

$120

$130

$140

$150

$160

Date

Closing

DGX

Price(1) DGX S&P 500

S&P

500

H.C. DGX S&P 500

S&P

500

H.C.

Total Shareholder Return Performance Graph Values

12/31/2001 ...................... $35.86 $100.00 $100.00 $100.00

12/31/2002 ...................... $28.45 –20.65% –22.10% –13.53% $ 79.35 $ 77.90 $ 86.47

12/31/2003 ...................... $36.56 28.49% 28.68% 28.16% $101.95 $100.25 $110.82

12/31/2004 ...................... $47.78 31.62% 10.88% 17.75% $134.19 $111.15 $130.50

12/31/2005 ...................... $51.48 8.51% 4.91% 17.81% $145.61 $116.61 $153.73

12/31/2006 ...................... $53.00 3.71% 15.79% 0.25% $151.00 $135.03 $154.11

(1) All values are adjusted to reflect the Company’s two-for-one stock splits that occurred on May 31, 2001 and

June 20, 2005.

Item 6. Selected Financial Data

See page 46.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

See page 48.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

See Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Item 8. Financial Statements and Supplementary Data

See Item 15 (a) 1 and 2.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

37