Priceline 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

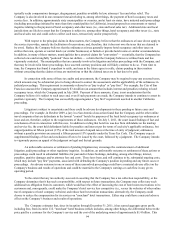

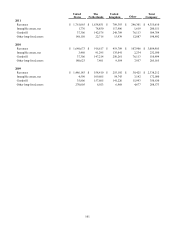

93

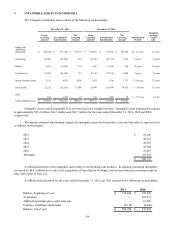

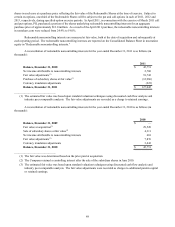

Income tax expense at federal statutory rate

Adjustment due to:

State taxes

Foreign rate differential

Innovation Box Tax benefit

Increase (decrease) in valuation allowance

Other

Income tax expense (benefit)

2011

$ 478,728

5,168

(125,824)

(48,101)

(14)

(1,294)

$ 308,663

2010

$ 261,199

6,762

(58,927)

(11,645)

69

20,683

$ 218,141

2009

$ 154,806

5,226

(31,892)

—

(183,272)

7,964

$(47,168)

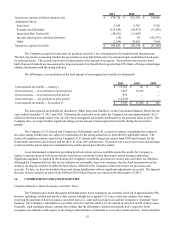

The Company accounts for uncertain tax positions based on a two step approach of recognition and measurement.

The first step involves assessing whether the tax position is more likely than not to be sustained upon examination based upon

its technical merits. The second step involves measurement of the amount to recognize. Tax positions that meet the more

likely than not threshold are measured at the largest amount of tax benefit that is greater than 50% likely of being realized upon

ultimate finalization with the taxing authority.

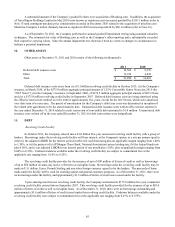

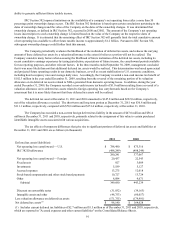

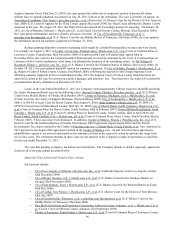

The following is a reconciliation of the total amount of unrecognized tax benefits (in thousands):

Unrecognized tax benefit — January 1

Gross increases — tax positions in current period

Gross increases — tax positions in prior period

Gross decreases — tax positions in prior period

Unrecognized tax benefit — December 31

2011

$ 13,386

1,455

876

(12,525)

$ 3,192

2010

$ 741

12,645

—

—

$ 13,386

2009

$ 741

—

—

—

$ 741

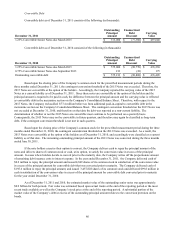

The unrecognized tax benefits are included in "Other long-term liabilities" on the Consolidated Balance Sheets for the

years ended December 31, 2011 and 2010. Following the conclusion of an audit, the Company reversed approximately $12.5

million in the three months ended June 30, 2011 for unrecognized tax benefits attributable to tax positions taken in 2010. The

Company does not expect further significant changes in the amount of unrecognized tax benefits during the next twelve

months.

The Company’s U.S. federal and Connecticut, Netherlands, and U.K. income tax returns, constituting the returns of

the major taxing jurisdictions, are subject to examination by the taxing authorities as prescribed by applicable statute. The

statute of limitations remains open for the Company's U.S. federal and Connecticut returns from 2008 and forward; for the

Netherlands from 2005 and forward; and for the U.K. from 2007 and forward. No income tax waivers have been executed that

would extend the period subject to examination beyond the period prescribed by statute.

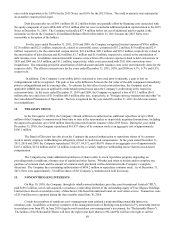

As an international corporation providing hotel reservation services available around the world, the Company is

subject to income taxes as well as non-income based taxes, in both the United States and various foreign jurisdictions.

Significant judgment is required in determining the Company's worldwide provision for income taxes and other tax liabilities.

Although the Company believes that its tax estimates are reasonable, there is no assurance that the final determination of tax

audits or tax disputes will not be different from what is reflected in the Company's historical income tax provisions and

accruals. To date, we have been audited in several taxing jurisdictions with no significant adjustments as a result. The Internal

Revenue Service initiated an audit of our 2009 and 2010 federal income tax returns in the third quarter of 2011.

16. COMMITMENTS AND CONTINGENCIES

Litigation Related to Hotel Occupancy and Other Taxes

The Company and certain third-party defendant online travel companies are currently involved in approximately fifty

lawsuits, including certified and putative class actions, brought by or against U.S. states, cities and counties over issues

involving the payment of hotel occupancy and other taxes (i.e., state and local sales tax) and the Company’s "merchant" hotel

business. The Company’s subsidiaries Lowestfare.com LLC and Travelweb LLC are named in some but not all of these cases.

Generally, each complaint alleges, among other things, that the defendants violated each jurisdiction’s respective hotel

occupancy tax ordinance with respect to the charges and remittance of amounts to cover taxes under each law. Each complaint